Most profitable crypto mining

With the rise of cryptocurrency, mining has become an increasingly popular way to earn money. However, not all cryptocurrencies are created equal when it comes to profitability. In this article, we will explore some of the most profitable crypto mining options available today.

One of the most well-known and profitable cryptocurrencies to mine is Bitcoin. As the first and largest cryptocurrency, Bitcoin mining offers significant rewards for miners. However, due to its popularity, the competition is fierce, and mining Bitcoin requires powerful hardware and significant energy consumption.

Ethereum is another cryptocurrency that has gained popularity among miners. Unlike Bitcoin, Ethereum uses a different mining algorithm called “proof of stake,” which requires less energy consumption. This makes it more accessible for miners with less powerful hardware. Additionally, Ethereum has a strong network and a growing community, making it a promising choice for miners.

Monero is a cryptocurrency that puts a strong emphasis on privacy and security. It uses a mining algorithm called “Cryptonight,” which is designed to be ASIC-resistant. This means that mining Monero is more accessible to individual miners using regular CPUs or GPUs. With its focus on privacy and a loyal community, Monero mining can be a profitable venture.

Litecoin, often referred to as the silver to Bitcoin’s gold, is another popular cryptocurrency to mine. It offers fast transaction confirmation times and a different mining algorithm called “scrypt.” This algorithm favors high-speed RAM, making it easier for miners to use consumer-grade hardware. As a result, Litecoin mining can be profitable for those with limited resources.

In conclusion, crypto mining can be a profitable venture for those willing to invest in the right hardware and stay up to date with the latest trends. While Bitcoin remains the most profitable cryptocurrency to mine, alternative options such as Ethereum, Monero, and Litecoin can also provide significant returns. Ultimately, miners should consider factors such as energy consumption, mining algorithm, and community support when choosing which cryptocurrency to mine.

Choosing the most profitable crypto mining hardware

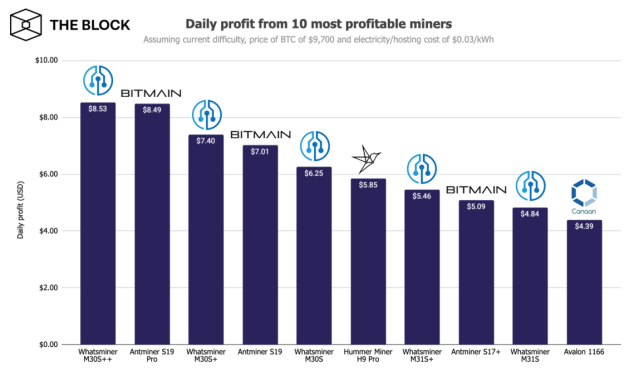

When it comes to crypto mining, choosing the right hardware is crucial in maximizing profits. The profitability of crypto mining is determined by various factors, including the miner’s hash rate, power consumption, and the type of cryptocurrency being mined. Therefore, it is important to select the most suitable hardware for the task.

One of the most popular options for crypto mining is ASIC (Application-Specific Integrated Circuit) miners. These miners are specifically designed to mine certain cryptocurrencies and offer high performance and efficiency. They are known for their ability to generate high hash rates while consuming less power compared to other mining hardware.

Another option to consider is GPU (Graphics Processing Unit) mining. GPUs are commonly used for gaming and graphic-intensive tasks, but they can also be used for crypto mining. GPU miners are more versatile than ASIC miners as they can mine different types of cryptocurrencies. They are also more affordable and easier to obtain compared to ASIC miners.

When choosing the most profitable crypto mining hardware, it is essential to consider the cost of the equipment and its profitability over time. While ASIC miners may offer higher efficiency, they are often more expensive upfront. On the other hand, GPU miners may have a lower initial cost but may require more power consumption in the long run.

Additionally, keeping an eye on the market trends is crucial. The profitability of crypto mining can fluctuate due to changes in the cryptocurrency market and mining difficulty. It is important to research and stay updated on the most profitable cryptocurrencies to mine and adjust the hardware accordingly.

In conclusion, choosing the most profitable crypto mining hardware involves considering factors such as performance, power consumption, cost, and market trends. Whether opting for ASIC or GPU miners, it is important to analyze the specific requirements and profitability of each option to make an informed decision and maximize profits.

Factors to consider when selecting mining equipment

When it comes to selecting mining equipment for cryptocurrency mining, there are several important factors that need to be considered. These factors can greatly impact the profitability and efficiency of the mining operation.

1. Hashrate: The hashrate refers to the amount of computational power that the mining equipment is capable of producing. A higher hashrate means faster and more efficient mining, resulting in a higher chance of successfully mining new blocks and earning rewards.

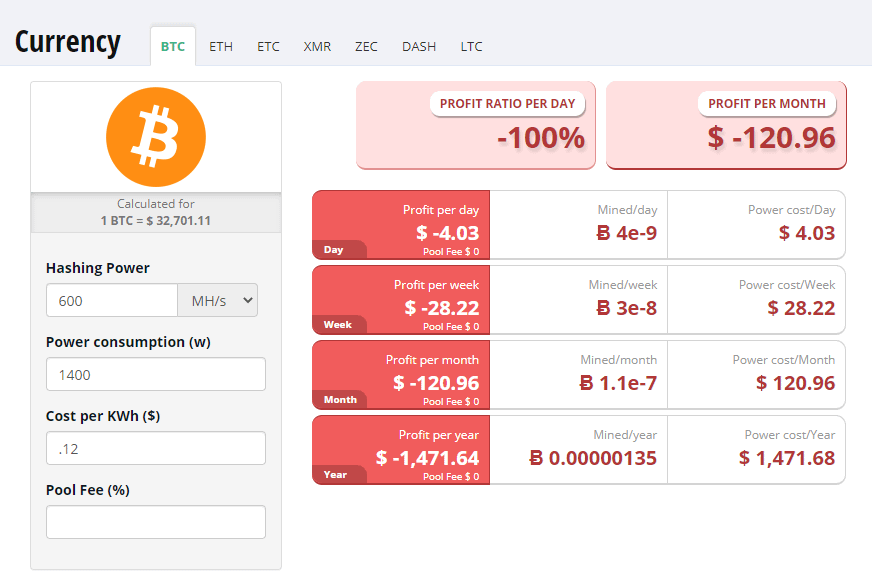

2. Power consumption: Mining equipment consumes a significant amount of electricity, so it’s crucial to consider the power consumption of the equipment. Lower power consumption means lower electricity costs and higher profitability.

3. Cost: The cost of the mining equipment is another important factor to consider. The initial investment in mining equipment can be significant, so it’s important to calculate the return on investment (ROI) and determine if the equipment will be profitable in the long run.

4. Cooling requirements: Mining equipment generates a lot of heat, so proper cooling is essential to maintain optimal performance. It’s important to consider the cooling requirements of the equipment and ensure that the mining facility or setup can handle the heat generated.

5. Reliability: Reliability is crucial in mining operations, as any downtime can result in lost mining rewards. It’s essential to select mining equipment from reputable manufacturers that have a track record of producing reliable and durable equipment.

6. Compatibility: The mining equipment should be compatible with the cryptocurrency being mined. Different cryptocurrencies may have different mining algorithms, so it’s important to ensure that the equipment can effectively mine the desired cryptocurrency.

7. Upgradability: As the cryptocurrency mining landscape evolves, it’s important to consider the upgradability of the mining equipment. Being able to upgrade the equipment’s hardware or software can help maintain competitiveness and adapt to changing mining conditions.

8. Noise and space: Mining equipment can be noisy and requires physical space. It’s important to consider the noise levels produced by the equipment and ensure that the mining facility or setup can accommodate the space requirements.

In conclusion, selecting the right mining equipment is crucial for a profitable and efficient cryptocurrency mining operation. By considering factors such as hashrate, power consumption, cost, cooling requirements, reliability, compatibility, upgradability, noise, and space, miners can make informed decisions and maximize their mining profitability.

Hashrate

The hashrate is an important factor in crypto mining that determines how quickly a miner can solve complex mathematical problems and validate transactions on the blockchain. It represents the computational power of a mining rig or network and is measured in hashes per second (H/s), kilohashes per second (KH/s), megahashes per second (MH/s), gigahashes per second (GH/s), or even terahashes per second (TH/s).

A higher hashrate indicates a greater computational power and, consequently, a higher chance of successfully mining new blocks and earning rewards. Miners with a higher hashrate are more likely to validate transactions faster and receive a larger share of the block rewards compared to those with a lower hashrate.

Hashrate can vary depending on the mining hardware used, such as CPUs, GPUs, or specialized ASICs. Different cryptocurrencies also have different mining algorithms, which can impact the hashrate required to mine profitably.

It is important for miners to consider the cost of equipment, electricity, and maintenance when determining the most profitable mining option based on hashrate. Additionally, the hashrate of a network can change over time as more miners join or leave, affecting the level of competition and potential rewards.

In summary, hashrate plays a crucial role in crypto mining as it directly affects the mining speed, profitability, and chances of earning rewards. Miners should carefully consider the hashrate of their equipment and the specific requirements of the cryptocurrency they wish to mine to maximize their earnings.

Energy Efficiency

The energy efficiency of crypto mining is an important factor to consider when evaluating the profitability of different cryptocurrencies. Energy efficiency refers to the amount of electricity required to mine a certain amount of cryptocurrency. The more energy-efficient a mining operation is, the lower its electricity costs will be, resulting in higher profits.

One way to measure the energy efficiency of a mining operation is through the calculation of the hash rate per unit of energy consumed. Hash rate refers to the speed at which a mining rig is able to solve a complex mathematical problem required to validate a transaction. The higher the hash rate per unit of energy consumed, the more energy-efficient the mining operation is.

Another factor that contributes to the energy efficiency of crypto mining is the type of hardware used. Some hardware, such as ASICs (Application-Specific Integrated Circuits), are specifically designed for mining cryptocurrencies and are more energy-efficient compared to general-purpose computer hardware. Investing in energy-efficient hardware can significantly reduce electricity costs and increase profitability.

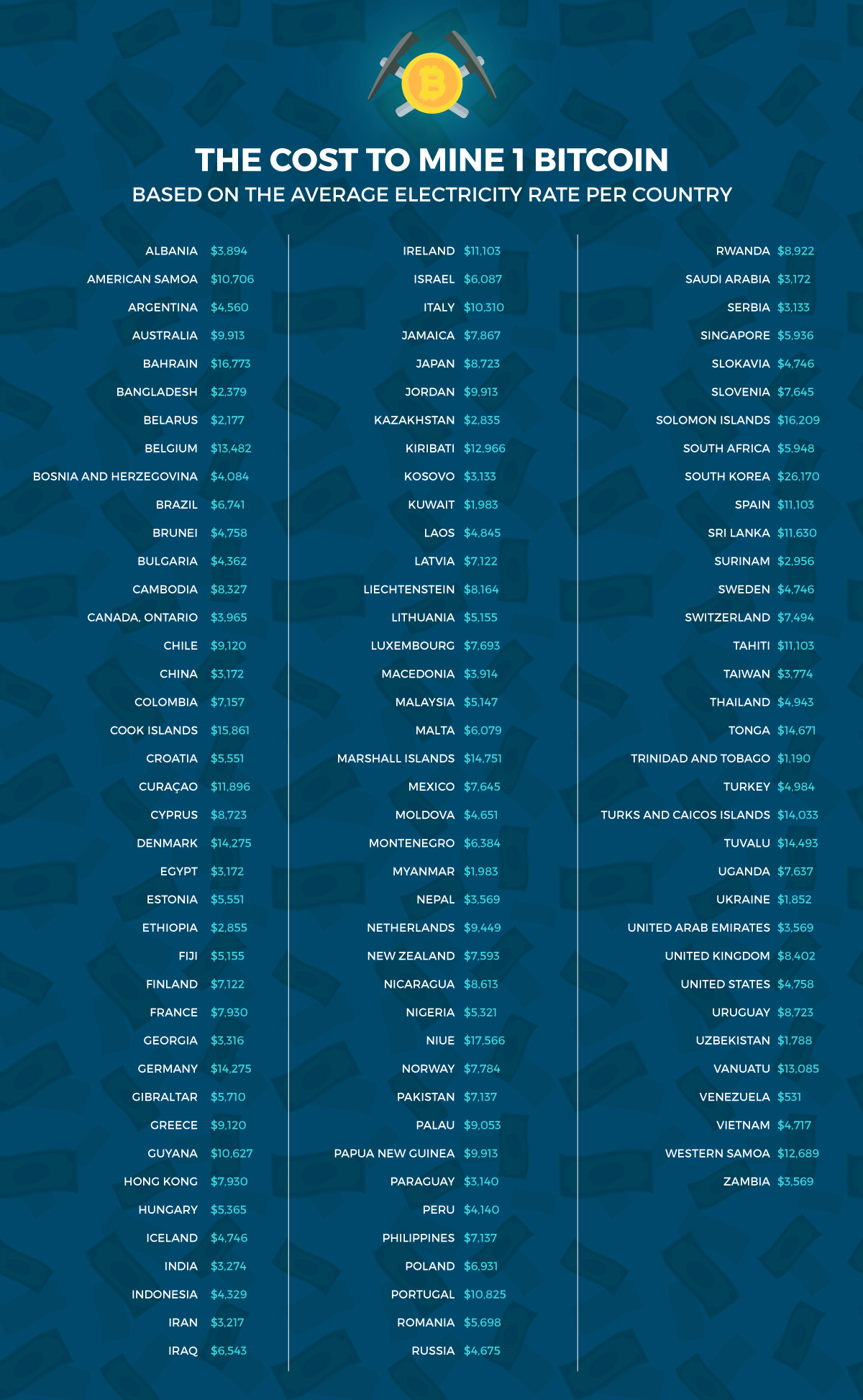

Furthermore, the location of a mining operation also plays a role in its energy efficiency. Areas with cheap electricity rates, such as countries with abundant renewable energy sources, can provide a competitive advantage to miners. By taking advantage of cheap and renewable energy, miners can reduce their electricity costs and increase their profit margins.

In conclusion, energy efficiency is a key consideration for crypto miners looking to maximize their profits. By optimizing their hash rate per unit of energy consumed, investing in energy-efficient hardware, and locating their operations in areas with cheap electricity, miners can increase their profitability in the highly competitive crypto mining market.

Cost of mining equipment

Mining cryptocurrency requires specialized equipment that is specifically designed for this purpose. The cost of mining equipment can vary significantly depending on numerous factors such as the type of cryptocurrency being mined, the processing power required, and the level of competition in the mining industry.

High-performance mining equipment, such as ASIC (application-specific integrated circuit) miners, can be quite expensive. These machines are specifically designed for mining cryptocurrencies and offer high processing power, which allows for more efficient mining. The cost of ASIC miners can range from a few hundred dollars to several thousands of dollars.

In addition to the cost of the initial purchase, mining equipment also requires ongoing maintenance and operational expenses. This includes electricity costs, cooling systems, and regular hardware upgrades to keep up with the ever-increasing difficulty of cryptocurrency mining.

It’s important for miners to carefully consider the cost of mining equipment and calculate the potential profitability before making a purchase. This involves estimating the mining rewards, factoring in the operational expenses, and considering the potential risks and challenges in the cryptocurrency market.

It’s also worth noting that the cost of mining equipment can be influenced by the availability and demand in the market. During periods of high demand, the prices of mining equipment may increase, making it more challenging for small-scale miners to enter the market.

In summary, the cost of mining equipment is a significant factor to consider when looking to enter the crypto mining industry. It’s important to assess the initial purchase cost, ongoing operational expenses, and potential profitability before investing in mining equipment. Additionally, monitoring the market for price fluctuations and availability can help miners make informed decisions about their equipment purchases.

Optimizing mining profitability

When it comes to crypto mining, optimizing profitability is a key goal for miners. Here are some strategies that miners can implement to maximize their earnings:

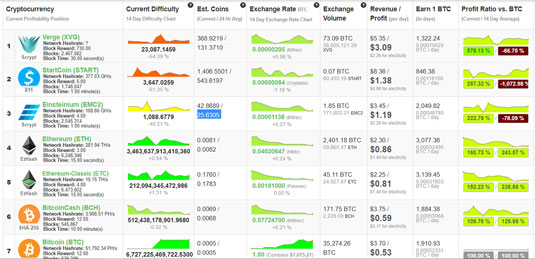

- Choosing the right cryptocurrency: Not all cryptocurrencies are equally profitable to mine. Miners should research and analyze different cryptocurrencies to find the ones that offer the best profitability. Factors to consider include the current price, mining difficulty, and potential for future price growth.

- Optimizing hardware: The right hardware can make a significant difference in mining profits. Miners should invest in powerful and efficient mining equipment to maximize their hash rate and energy efficiency. Regularly updating hardware and utilizing overclocking techniques can also enhance profitability.

- Selecting the right mining pool: Joining a mining pool can increase the chances of earning consistent rewards. Miners should choose a pool with a low fee structure and a strong reputation. Additionally, selecting a pool with a large network hashrate can improve the chances of finding blocks more frequently.

- Managing energy costs: Energy consumption is a significant expense in crypto mining. Miners can optimize profitability by choosing locations with low electricity costs or utilizing renewable energy sources. Additionally, implementing energy-efficient mining equipment and minimizing downtime can help reduce energy expenses.

- Monitoring and adjusting: To optimize profitability, miners should continuously monitor their mining operation and make necessary adjustments. This includes staying updated with market trends, adjusting mining settings according to network difficulty, and regularly assessing the performance of mining equipment.

By implementing these strategies, miners can increase their chances of maximizing profitability in the crypto mining industry. It is important to adapt to the ever-changing market conditions and stay informed about the latest developments in the industry to maintain a competitive edge.

Selecting the right cryptocurrency to mine

When it comes to crypto mining, selecting the right cryptocurrency to mine is crucial in maximizing profitability. With hundreds of cryptocurrencies available, each with its own unique features and mining algorithms, it’s important to consider several factors before making a decision.

1. Mining Difficulty: The mining difficulty determines how hard it is to mine a new block in a particular cryptocurrency’s blockchain. Higher mining difficulty means more computational power and electricity are required, which can impact profitability. It’s advisable to choose a cryptocurrency with a lower mining difficulty to increase the chances of earning rewards.

2. Market Value: The market value of a cryptocurrency directly affects its profitability. Higher market value means greater returns when the mined cryptocurrency is sold or exchanged. Before investing in mining equipment and resources, it’s important to evaluate the potential market value of the selected cryptocurrency.

3. Mining Algorithm: Different cryptocurrencies use different mining algorithms, such as SHA-256, Scrypt, or Equihash. Each algorithm requires specific hardware and computing power. Researching and understanding the mining algorithm of a cryptocurrency can help ensure compatibility with existing mining equipment or determine the need for specialized hardware.

4. Mining Rewards: Mining rewards play a significant role in profitability. Some cryptocurrencies offer fixed rewards for each mined block, while others have halving mechanisms that reduce rewards over time. It’s important to consider the mining rewards and any potential changes in the future to make an informed decision.

5. Long-Term Viability: Before selecting a cryptocurrency to mine, it’s essential to assess its long-term viability. Factors such as the development team, community support, and future roadmap can indicate the potential for growth and sustainability. Investing time and resources into a cryptocurrency with long-term viability can lead to more profitable mining.

In conclusion, selecting the right cryptocurrency to mine involves careful consideration of factors such as mining difficulty, market value, mining algorithm, mining rewards, and long-term viability. By evaluating these factors, miners can increase their chances of profitability and make informed decisions in the ever-evolving world of crypto mining.

Joining a mining pool

Joining a mining pool is a popular option for individuals interested in crypto mining. A mining pool is a group of miners who combine their computing power to increase their chances of successfully mining cryptocurrencies. Instead of competing against each other, pool members work together to solve complex mathematical problems and share the rewards.

One of the main advantages of joining a mining pool is the increased likelihood of earning a steady income. By pooling their resources, miners have a higher chance of successfully mining blocks and receiving rewards on a regular basis. This can be especially beneficial for miners with limited computing power or access to expensive mining equipment.

Joining a mining pool also allows miners to benefit from shared resources and expertise. Pool members often have access to specialized hardware and software, as well as a community of experienced miners. This can help newcomers to the world of crypto mining learn and improve their mining skills, increasing their profitability in the long run.

When considering a mining pool to join, it’s important to evaluate factors such as pool fees, payout methods, and the pool’s reputation and reliability. Some pools may charge a fee for participating, while others may have different payout methods or minimum payout thresholds. Additionally, researching and choosing a reputable and trustworthy pool can help minimize the risks associated with joining a pool.

In summary, joining a mining pool can be a profitable choice for individuals interested in crypto mining. By working together with other miners, pool members can increase their chances of earning a steady income and benefit from shared resources and expertise. However, it is important to carefully research and choose a reputable mining pool to ensure a positive and profitable mining experience.

Regularly monitoring and adjusting mining operations

Profitability in crypto mining is highly dependent on several factors, including the value of the cryptocurrency being mined, the cost of electricity, and the efficiency of the mining hardware. These factors can fluctuate over time, making it crucial for miners to regularly monitor and adjust their operations to ensure maximum profitability.

One important aspect of monitoring mining operations is keeping track of the current market value of the cryptocurrency being mined. This value can vary significantly, and it is essential to be aware of any major changes that may impact profitability. By staying informed, miners can make informed decisions about whether to continue mining a particular cryptocurrency or switch to a more profitable option.

Electricity costs also play a significant role in the profitability of mining operations. As electricity prices change, miners must carefully evaluate their expenses to ensure that they are not spending more on electricity than the value of the cryptocurrency they are mining. Regularly reviewing electricity bills and exploring options for more cost-effective energy sources, such as renewable energy, can help miners optimize their operations.

In addition to monitoring market value and electricity costs, miners also need to assess the efficiency of their mining hardware. Over time, mining equipment can become less efficient, leading to lower profitability. Regularly evaluating the performance of hardware components and considering upgrades or replacements can help miners maintain optimal profitability.

It is also important for miners to stay up to date with the latest advancements in mining technology and strategies. The crypto mining landscape is constantly evolving, and new hardware, software, and techniques may emerge that could significantly improve profitability. Being proactive and staying informed about these developments can give miners a competitive edge and help them maximize their earnings.

FAQ:

Which cryptocurrency is currently the most profitable to mine?

The most profitable cryptocurrency to mine currently is Ethereum.

What factors affect the profitability of crypto mining?

Several factors can affect the profitability of crypto mining, including the price of the cryptocurrency being mined, the mining difficulty, the cost of electricity, and the mining hardware’s efficiency.

Is it still profitable to mine Bitcoin?

Mining Bitcoin can still be profitable, but it requires specialized mining equipment and access to cheap electricity in order to be competitive.

What is the mining difficulty?

The mining difficulty is a measure of how difficult it is to find a hash below a given target. As more miners join the network, the difficulty increases, making it harder to mine new blocks.

How much electricity does cryptocurrency mining consume?

Cryptocurrency mining can consume a significant amount of electricity, especially for mining cryptocurrencies like Bitcoin. Estimates suggest that Bitcoin mining alone consumes more electricity than many countries.

Are there any alternative cryptocurrencies that are profitable to mine?

Yes, there are several alternative cryptocurrencies that can be profitable to mine, such as Litecoin, Bitcoin Cash, and Monero.

What are the best mining hardware options for profitable crypto mining?

Some of the best mining hardware options for profitable crypto mining include ASIC miners for Bitcoin and high-performance GPUs for mining other cryptocurrencies like Ethereum.

Video:

Crypto Mining: The ULTIMATE Passive Income

is a renowned author in the field of cryptocurrency and blockchain technology. With over a decade of experience, he has written numerous articles and books that have helped both beginners and experts understand the intricacies of the crypto world. James has a deep understanding of mining hardware and has been instrumental in providing valuable insights to crypto enthusiasts. His passion for technology and commitment to sharing knowledge make him a trusted source in the industry.

cryptomaster123

11.09.2023 at 10:10

Bitcoin mining is definitely the most profitable option right now. With its high value and demand, mining Bitcoin can bring in significant profits. However, it’s important to invest in powerful hardware and keep up with the competition. Happy mining!

cryptomineprofit

14.09.2023 at 20:17

As a crypto mining enthusiast, I have found Bitcoin to be the most profitable cryptocurrency to mine. Despite the competition, the rewards can be significant if you have the right hardware and energy resources. However, Ethereum’s proof of stake algorithm is also worth considering for those with less powerful equipment. Monero’s emphasis on privacy and accessibility for individual miners is commendable as well. Happy mining!

crypto4lyfe

18.09.2023 at 06:25

Bitcoin mining is definitely the most profitable option, but the competition is just too fierce. It’s like trying to swim with sharks! For us small-time miners, Ethereum is the way to go. It’s easier on the hardware and energy consumption, and with its growing community, it’s definitely a promising choice. Happy mining, everyone!

crypto_wiz

21.09.2023 at 16:30

Wow, this article provides some great insights into the most profitable crypto mining options. It’s fascinating to see how different cryptocurrencies require different mining algorithms and hardware. I’m definitely going to look into mining Ethereum, as it seems like a promising choice with its energy consumption and strong network. Thanks for the informative article!

Lucy1894

25.09.2023 at 02:32

I think Bitcoin mining is still the most profitable option despite the fierce competition and high energy consumption. It has been proven to yield significant rewards for miners.

crypto_king

28.09.2023 at 12:33

I’ve been mining Bitcoin for years and it’s definitely the most profitable cryptocurrency to mine. Yes, the competition is tough, but the rewards are worth it when you have powerful hardware and the right mining strategy. Happy mining!

JohnDoe123

01.10.2023 at 22:36

Can you provide more information on the strategies and tools to optimize crypto mining profitability?

AliceCryptoX

05.10.2023 at 08:43

Sure, JohnDoe123! Optimizing crypto mining profitability requires a combination of strategies and tools. First, you can consider mining pools, which allow miners to combine their resources and increase their chances of earning rewards. Pooling resources also helps in reducing the impact of mining difficulty. Second, you can focus on selecting the right hardware for mining. Look for high hash rates and low power consumption to maximize efficiency. Additionally, monitoring and managing energy consumption is vital to minimize costs. Finally, staying updated with the latest market trends and adjusting your mining strategy accordingly will give you an edge. Good luck with your mining ventures!

BlockchainGuru007

08.10.2023 at 18:43

Is there any new upcoming cryptocurrency that is potentially more profitable to mine than Bitcoin and Ethereum?

CryptoExpert2021

12.10.2023 at 04:46

Yes, there are several new cryptocurrencies that have the potential to be more profitable to mine than Bitcoin and Ethereum. One example is Ripple. Ripple is known for its fast transaction speeds and low fees, which make it an attractive choice for miners. Another potential option is Cardano, which aims to provide a more sustainable and scalable platform for decentralized applications. It’s always a good idea to stay informed about the latest developments in the crypto space to maximize your mining profitability.

JohnSmith123

15.10.2023 at 14:54

What other cryptocurrencies besides Bitcoin, Ethereum, and Monero are profitable for mining?

AliceCryptoExpert

29.10.2023 at 07:18

There are several other cryptocurrencies that can be profitable for mining. One such option is Litecoin. It is often considered the silver to Bitcoin’s gold and has a strong community support. Another profitable option is Dogecoin, which started as a meme coin but has gained popularity and value over time. Lastly, Ravencoin is worth considering as it is designed specifically for asset transfers and has a growing ecosystem. These are just a few examples, but there are many other profitable cryptocurrencies out there to explore! Happy mining!

cryptoGuru123

19.10.2023 at 01:01

I’ve been mining Bitcoin for a while now and it has definitely been the most profitable choice for me. The competition is tough, but with the right hardware and energy consumption management, it’s worth it. Happy mining everyone!

crypto_king

22.10.2023 at 11:08

I’ve been mining Bitcoin for several years now and it has definitely been the most profitable cryptocurrency for me. However, it does come with its challenges, especially with the increasing competition and the need for powerful hardware. But if you’re willing to invest in the right equipment, the rewards can be significant.

CryptoExpert123

25.10.2023 at 21:13

As an experienced miner, I can confirm that Bitcoin mining may be profitable, but it requires substantial investment in hardware and electricity. Ethereum, on the other hand, seems to be a more accessible option with its proof of stake algorithm. Monero’s emphasis on privacy and ASIC resistance is also intriguing. It’s essential to choose the right cryptocurrency to mine and stay updated with the latest mining strategies.

crypto_pro88

01.11.2023 at 17:19

Bitcoin mining is definitely the most profitable option, but the competition is intense. You need top-notch hardware and huge energy consumption to make it worthwhile.

crypto_maniac

05.11.2023 at 03:20

Bitcoin mining is definitely the most profitable option out there. With its high rewards and global popularity, it’s worth investing in powerful hardware and energy consumption. Don’t miss out on the opportunity to maximize your earnings!

Sarah90

08.11.2023 at 14:28

I think Bitcoin mining is still the most profitable option, despite the competition and energy consumption. It’s been around for a long time and has a solid track record.

cryptoMaster2000

12.11.2023 at 01:29

Are there any cryptocurrencies besides Bitcoin, Ethereum, and Monero that are worth mining?

ExpertCryptoMiner

18.11.2023 at 23:32

Yes, there are other cryptocurrencies worth mining besides Bitcoin, Ethereum, and Monero. One example is Litecoin. It is often referred to as the “silver to Bitcoin’s gold” and has a strong following. Another one is Ripple, which is gaining popularity for its fast transaction times and low fees. Zcash is also worth considering, as it offers enhanced privacy features. Keep in mind that the profitability of mining these cryptocurrencies may vary, so it’s important to do your research and stay updated on the market trends.

crypto_enthusiast_25

15.11.2023 at 12:31

I think Bitcoin mining is still the most profitable option. Despite the competition and energy consumption, the rewards are significant. Those with powerful hardware have a clear advantage.

AlexJordan

22.11.2023 at 10:52

What strategies can I use to optimize my crypto mining profitability?

EmmaBrown

06.12.2023 at 07:12

Hey AlexJordan, optimizing your crypto mining profitability can be achieved through several strategies. Firstly, you can start by choosing the right cryptocurrency to mine. Research the market conditions and select a cryptocurrency with high potential for growth and profitability. Additionally, consider joining a mining pool to increase your chances of earning rewards. Pooling resources with other miners allows for a more consistent mining income. Another important strategy is to regularly monitor and adjust your mining hardware and software settings. Updating your equipment and optimizing your mining software can help improve efficiency and maximize profits. Stay informed about the latest developments in the crypto mining landscape, as new technologies and strategies emerge regularly. Finally, make sure to manage your energy consumption effectively to reduce costs. Good luck with your mining endeavors!

JohnDoe24

25.11.2023 at 21:59

I have been mining Bitcoin for a while now, and it has been a profitable venture. The competition is tough, but with the right hardware, it is definitely worth it. Plus, the growing value of Bitcoin makes it even more lucrative.

JohnCryptoPro

29.11.2023 at 09:03

Bitcoin mining is definitely the most profitable option for me. Although it requires powerful hardware and consumes a lot of energy, the significant rewards make it worth the investment. Plus, with its dominance in the crypto market, there’s always a demand for Bitcoin.

cryptominer007

02.12.2023 at 20:06

Is mining Bitcoin still profitable in today’s market? It seems like the competition is getting tougher.

cryptoexpert89

13.12.2023 at 05:18

Yes, mining Bitcoin can still be profitable in today’s market. While it is true that the competition has increased, there are still opportunities to earn significant rewards. However, it is important to have powerful hardware and efficient energy consumption to stay ahead of the competition. Additionally, considering alternative cryptocurrencies with less competition can also be a profitable strategy.

Jeff_Stark

09.12.2023 at 18:13

I believe that Bitcoin mining is still the most profitable option, despite the fierce competition. With the right hardware and energy consumption, the rewards can be significant. However, Ethereum is also a promising choice due to its lower energy requirements and strong community support.

BitcoinLover82

16.12.2023 at 16:21

I’ve been mining Bitcoin for a while now, and I can say that it’s definitely the most profitable cryptocurrency to mine. The competition is tough, but the rewards are worth it. Just make sure you have powerful hardware and can handle the energy consumption.

JohnSmith

20.12.2023 at 03:26

I have been mining Bitcoin for a while now and it has definitely been the most profitable crypto for me. The competition is tough, but with the right hardware and energy consumption, it’s definitely worth it.

SarahCryptoExpert

23.12.2023 at 14:27

I think Ethereum is a great option for miners looking to optimize their profitability. The proof of stake algorithm not only consumes less energy but also allows miners with less powerful hardware to participate. Plus, its strong network and growing community make it an attractive choice for long-term earnings.

JohnSmith123

27.12.2023 at 01:29

Great article, but what about other profitable cryptocurrencies to mine? Are there any hidden gems that are worth considering?

ExpertMiner

30.12.2023 at 12:35

Hi JohnSmith123, thank you for your comment. In addition to Bitcoin, Ethereum, and Monero mentioned in the article, there are indeed other profitable cryptocurrencies to mine. One example is Litecoin, which is often referred to as the silver to Bitcoin’s gold. It uses a different mining algorithm called “Scrypt” and offers faster block generation times. Another option is Zcash, which focuses on privacy and uses a mining algorithm called “Equihash.” Both Litecoin and Zcash have their own unique benefits and mining communities worth exploring. Happy mining!

cryptoqueen

02.01.2024 at 23:36

Are there any other cryptocurrencies besides Bitcoin, Ethereum, and Monero that are profitable to mine?

CryptoExpert

06.01.2024 at 10:39

Yes, there are several other cryptocurrencies besides Bitcoin, Ethereum, and Monero that can be profitable to mine. One example is Litecoin, which is often referred to as the “silver” to Bitcoin’s “gold.” It is similar to Bitcoin but has faster block generation times and a different hashing algorithm. Another option is Zcash, a privacy-focused cryptocurrency that uses zero-knowledge proofs to enhance security. Other profitable cryptocurrencies to consider include Dash, Bitcoin Cash, and Ravencoin. It’s always a good idea to research and stay updated on the latest trends and developments in the crypto mining world. Happy mining!

BitcoinMiner78

09.01.2024 at 21:47

I have been mining Bitcoin for a few years now and it has definitely been one of the most profitable cryptocurrencies to mine. The rewards are great, but you really need to invest in powerful hardware to stay competitive. It’s a tough market out there, but if you have the resources, it’s definitely worth it!

cryptominer101

13.01.2024 at 08:48

I’ve been mining Bitcoin for a while now and it’s definitely the most profitable cryptocurrency to mine. Yes, the competition is tough, but the rewards are worth it. Just make sure you have the right hardware and energy supply for it.

CryptoEnthusiast123

16.01.2024 at 19:51

I think Bitcoin mining is still the most profitable option. Despite the competition and energy consumption, the rewards are worth it if you have the right setup and resources.

crypto_miner_85

20.01.2024 at 06:58

I have been mining Bitcoin for a while now and I can definitely say that it is one of the most profitable options out there. The competition is tough, but with the right hardware and strategies, it is possible to maximize earnings. However, I have also started mining Ethereum recently and have been impressed by its energy efficiency and strong community. It’s definitely worth considering as well.

JohnSmith

23.01.2024 at 18:06

Bitcoin mining seems like a lucrative opportunity to earn some extra income. However, the competition and energy consumption required make it quite challenging. I’m personally more inclined towards mining Ethereum as it offers a promising choice with its proof of stake algorithm and growing community.

BitcoinA1

27.01.2024 at 05:10

Bitcoin mining is definitely the most profitable option right now. But with the increasing competition and energy consumption, it’s becoming harder for individual miners to make a significant profit.

Jennifer78

30.01.2024 at 16:13

Thanks for the informative article! I’ve been mining Bitcoin for a while now, and it’s definitely been a profitable venture. The competition can be tough, but with the right hardware and energy management, it’s worth it.

cryptoexpert24

03.02.2024 at 03:17

I have been mining cryptocurrencies for years, and in my experience, Bitcoin is still the most profitable option. Despite the competition, the rewards are worth the investment in hardware and energy consumption. Don’t miss out on the opportunity!

crypto_miner_123

06.02.2024 at 14:23

Are there any other profitable cryptocurrencies to mine besides Bitcoin, Ethereum, and Monero?

crypto_enthusiast_456

13.02.2024 at 12:33

Definitely! There are several other profitable cryptocurrencies to mine besides Bitcoin, Ethereum, and Monero. Some of the notable ones include Litecoin, Dash, Zcash, and Dogecoin. Each of these cryptocurrencies offers different mining algorithms and potential profitability. For example, Litecoin uses Scrypt algorithm and is often considered as the silver to Bitcoin’s gold. Dash, on the other hand, focuses on fast and secure transactions with its X11 algorithm. Zcash offers enhanced privacy features with its zk-SNARKs technology. And who can forget Dogecoin, the friendly and fun cryptocurrency that started as a meme? So, there are plenty of options out there for miners to explore and find their own profitable ventures. Happy mining!

mining_expert_789

16.02.2024 at 23:34

Indeed, there are numerous other cryptocurrencies that can be profitable to mine in addition to Bitcoin, Ethereum, and Monero. Litecoin, Dash, Zcash, and Dogecoin are just a few examples worth mentioning. Each of these cryptocurrencies utilizes different mining algorithms and offers unique profitability potential. For instance, Litecoin employs the Scrypt algorithm and is often regarded as the silver to Bitcoin’s gold. Meanwhile, Dash focuses on facilitating fast and secure transactions through its X11 algorithm. Zcash boasts enhanced privacy features thanks to its zk-SNARKs technology. And who can overlook Dogecoin, the friendly and amusing cryptocurrency that originated as a meme? As such, miners have a plethora of options to explore and discover their own lucrative ventures. Happy mining!

crypto_enthusiast_123

23.02.2024 at 21:42

As a passionate crypto miner, I couldn’t agree more with mining_expert_789’s insightful comment. Diversifying your mining portfolio beyond Bitcoin, Ethereum, and Monero can indeed open up a world of profitable opportunities. Exploring cryptocurrencies like Litecoin, Dash, Zcash, and Dogecoin with their unique features and algorithms can lead to exciting ventures and enhanced profitability. It’s all about staying informed, adaptive, and seizing the right opportunities in the dynamic crypto mining landscape. Happy mining to all fellow miners!

crypto_guru84

10.02.2024 at 01:30

I’ve been mining Bitcoin for years now and it’s definitely been the most profitable cryptocurrency for me. The competition is tough, but with the right hardware and energy resources, the rewards are worth it. Plus, the value of Bitcoin keeps increasing, so it’s a win-win situation.

Alice1985

20.02.2024 at 10:38

Mining cryptocurrencies has become a lucrative endeavour with the evolving landscape. I believe that Bitcoin, Ethereum, and Monero each offer unique opportunities for profitability. It’s crucial for miners to strategically choose the right coin based on their resources and goals to stay competitive in this dynamic market.

EmilyCryptoExpert

27.02.2024 at 08:54

As an experienced miner, I totally agree with the article’s insights. Bitcoin may offer significant rewards, but the fierce competition demands powerful hardware and high energy consumption. Ethereum, with its proof of stake algorithm, provides a more accessible option for miners with less powerful setups. Monero’s focus on privacy sets it apart, making it a promising choice for individual miners. Stay informed and choose wisely!

EmmaSmith2021

01.03.2024 at 19:57

Which cryptocurrencies, besides Bitcoin, offer good profitability for mining? Are there any upcoming cryptocurrencies worth considering for mining in the future?

JohnDoe1985

05.03.2024 at 07:00

Hey EmmaSmith2021, besides Bitcoin, Ethereum and Monero are also great options for profitable mining. Ethereum’s ‘proof of stake’ algorithm is energy-efficient, while Monero’s emphasis on privacy makes it an attractive choice. As for upcoming cryptocurrencies, keep an eye on projects like Cardano and Polkadot which show potential for future mining profitability.

EmilySmith

08.03.2024 at 18:00

As an experienced miner, I believe that focusing on Ethereum mining could be a wise choice for those looking to maximize profits. Its “proof of stake” algorithm not only requires less energy but also offers a promising future with its strong network and growing community. Stay ahead of the game by exploring Ethereum as a profitable crypto mining option!

AmyCryptoExpert

12.03.2024 at 04:07

In my opinion, Bitcoin continues to be the most profitable cryptocurrency to mine, despite the intense competition and high energy demands. Ethereum is also a strong contender due to its energy-efficient proof of stake algorithm, making it accessible to a wider range of miners. Monero’s focus on privacy and ASIC-resistant mining algorithm adds to its appeal for individual miners looking to maximize their earnings.

EmilySmith

15.03.2024 at 14:19

Mining cryptocurrencies can be a profitable venture if you choose the right coins and optimize your setup. Bitcoin may offer significant rewards, but the competition and energy consumption are major factors to consider. Ethereum’s proof of stake algorithm provides a more energy-efficient option, while Monero’s focus on privacy appeals to those looking for a secure mining experience.

AlexCryptoGuru

19.03.2024 at 00:22

Bitcoin mining offers significant rewards, but the competition is fierce. Ethereum’s proof of stake makes it more accessible to miners with less powerful hardware, while Monero’s ASIC-resistant algorithm allows individual miners to participate.

EmmaCryptoExpert

22.03.2024 at 10:36

When it comes to profitable crypto mining, it’s crucial to stay informed about the latest trends and strategies. I believe that diversifying your mining portfolio with a mix of Bitcoin, Ethereum, and Monero could help maximize your earnings. Remember, staying ahead of the competition is key in this rapidly changing landscape.

AlexandraSmith87

25.03.2024 at 20:37

As a crypto miner myself, I completely agree with the insights shared in this article. Bitcoin mining may have high rewards but the competition is tough. Ethereum’s proof of stake approach is definitely more attractive for miners like me with standard hardware. Monero’s focus on privacy also makes it a top choice for miners concerned about security.

EmilyCryptoTrader

29.03.2024 at 06:39

Which cryptocurrencies, besides Bitcoin and Ethereum, are currently considered the most profitable for mining? Are there any upcoming cryptocurrencies that show potential for high profitability in mining?

NathanCryptoExpert

01.04.2024 at 16:39

Hi EmilyCryptoTrader, besides Bitcoin and Ethereum, some of the most profitable cryptocurrencies for mining currently include Litecoin, Bitcoin Cash, and Dash. These coins have strong communities and offer good mining rewards. As for upcoming cryptocurrencies, projects like Chia and Filecoin are generating interest in the mining community due to their unique protocols and potential for high profitability. Keep an eye on these projects for future mining opportunities!

SamLovesCrypto

05.04.2024 at 02:41

Interesting article! Do you think mining Ethereum could be a more profitable option compared to Bitcoin in the long run?

MiaCryptoEnthusiast

23.04.2024 at 01:32

Sure, SamLovesCrypto! With Ethereum’s lower energy consumption and promising network growth, mining Ethereum could indeed be a more profitable long-term option compared to Bitcoin.

EmmaSmith91

08.04.2024 at 12:43

Which cryptocurrencies, other than Bitcoin and Ethereum, do you recommend for profitable mining? Are there any emerging options worth considering?

JohnDoe82

26.04.2024 at 11:40

Hey EmmaSmith91, besides Bitcoin and Ethereum, I would recommend looking into Litecoin and Dogecoin for profitable mining. Both of these cryptocurrencies have a strong community and relatively stable profitability. As for emerging options, keep an eye on Cardano and Polkadot, which have been gaining traction in the crypto world recently. Happy mining!

AliceSmith

11.04.2024 at 22:43

Which cryptocurrencies, other than Bitcoin and Ethereum, do you recommend for profitable mining in the current market?

JohnDoe

29.04.2024 at 22:08

As an experienced crypto miner, I would recommend looking into Litecoin and Dogecoin for profitable mining options in the current market. These cryptocurrencies have shown stable performance and have a dedicated community supporting their mining activities. Keep an eye on their market trends and consider adding them to your mining portfolio for diversification and potential profitability.

EmmaSmith_89

15.04.2024 at 08:48

Mining cryptocurrencies can be a lucrative venture if you choose the right ones. Bitcoin may offer significant rewards, but the competition is tough. Ethereum, with its energy-efficient mining algorithm, is a promising alternative for miners with less powerful hardware. Monero’s focus on privacy makes it an attractive option for those concerned about security. It’s essential to stay informed about the most profitable options in the ever-changing crypto mining landscape to maximize earnings.

AmyCryptoExpert

19.04.2024 at 15:17

As a seasoned miner, I can attest to the profitability of Bitcoin mining despite the fierce competition. However, Ethereum’s energy-efficient mining algorithm makes it a more promising choice for miners with less powerful hardware.

Emma123

03.05.2024 at 08:16

Bitcoin mining offers significant rewards, but the competition is fierce, and powerful hardware is needed. Ethereum, with its “proof of stake” algorithm, is more energy-efficient and accessible to miners with less powerful hardware. Monero’s ASIC-resistant algorithm makes it a promising choice for individual miners using regular CPUs or GPUs.

CharlieSmith87

06.05.2024 at 18:26

Do you have any specific recommendations for tools that can help optimize mining profitability for these cryptocurrencies?

EmilyJones92

10.05.2024 at 04:44

Hey CharlieSmith87! When it comes to optimizing mining profitability for cryptocurrencies like Bitcoin, Ethereum, and Monero, there are several tools you can consider. For Bitcoin mining, tools like CGMiner and BFGMiner are popular choices for optimizing hash rates and managing hardware efficiently. For Ethereum, Ethminer and Claymore are commonly used tools for maximizing GPU performance. When it comes to Monero, XMRig and MinerGate are recommended for CPU and GPU mining optimization. Remember to regularly monitor and adjust your mining strategies to stay profitable in the competitive crypto mining landscape!

JoannaSmith92

13.05.2024 at 14:47

Mining cryptocurrencies can be a lucrative venture if you choose the right options. Bitcoin remains a top choice for many, but the competition is intense. Ethereum’s energy-efficient approach makes it a compelling alternative. Monero’s focus on privacy is also appealing for miners looking for security.

EmmaSmith92

17.05.2024 at 01:01

Which cryptocurrency currently offers the highest profitability for mining?

JohnCryptoExpert

20.05.2024 at 11:04

Hi EmmaSmith92, considering the current market trends, Ethereum stands out as one of the most profitable cryptocurrencies for mining due to its energy-efficient “proof of stake” algorithm. It offers a good balance between potential rewards and accessibility for miners with varying hardware capabilities. However, it’s always advisable to stay updated with the latest market shifts to maximize your mining profitability. Happy mining!

Emma87

23.05.2024 at 21:26

Which of these cryptocurrencies currently offers the highest profitability for mining?

JohnSmith

27.05.2024 at 08:12

Hi Emma87, among the cryptocurrencies mentioned, currently, Ethereum tends to offer the highest profitability for mining due to its lower energy consumption requirements and growing community support. However, it’s always recommended to regularly monitor the market trends to capitalize on the most profitable opportunities. Happy mining!

EmmaSmith87

30.05.2024 at 20:03

As an experienced miner, I must say that Ethereum’s mining algorithm provides a more energy-efficient option compared to Bitcoin. With its growing community and strong network, Ethereum is definitely a promising choice for those looking to maximise their earnings in crypto mining.

AlexandraSmith89

03.06.2024 at 06:10

As a crypto miner myself, I agree that Bitcoin’s profitability comes with intense competition and high energy consumption. Ethereum’s proof of stake algorithm, on the other hand, makes it a more sustainable option for miners with limited resources. Monero’s focus on privacy and ASIC-resistant mining algorithm also makes it an attractive choice for those looking for a more accessible mining opportunity.

EmmaCryptoEnthusiast

06.06.2024 at 16:32

Which of these cryptocurrencies would you recommend for someone just starting out with mining, looking to maximize profits?

JackCoinExpert

20.06.2024 at 09:11

For someone new to mining and aiming to maximise profits, I would recommend starting with Ethereum. Its proof of stake algorithm requires less energy consumption, making it more cost-effective for beginners with less powerful hardware. Plus, Ethereum’s strong network and community support provide a promising opportunity for growth in mining earnings.

Jenny_1985

10.06.2024 at 02:39

Could you please provide more details on the tools recommended for optimizing crypto mining profitability?

Charlie_1990

23.06.2024 at 19:20

Sure! When it comes to optimizing your crypto mining profitability, there are several tools you can consider. Some popular options include mining software like NiceHash or MinerGate, which help you maximize your hash rate and overall efficiency. Additionally, hardware such as ASIC miners or high-performance GPUs can significantly improve your mining capabilities. It’s also essential to stay updated on market trends and adjust your strategies accordingly to stay profitable in the competitive crypto mining landscape.

Emma86

13.06.2024 at 12:40

Could you clarify which specific tools are recommended for optimizing profitability in Ethereum mining? Thank you!

JohnSmith72

27.06.2024 at 05:27

Sure thing, Emma86! When it comes to optimizing profitability in Ethereum mining, one of the key tools recommended is a mining software called Claymore Miner. This software allows for efficient mining and tweaking of settings to maximize your earnings. Additionally, using a mining pool can help increase your chances of getting consistent payouts. Lastly, staying updated with the latest news and developments in the Ethereum network can also give you an edge in maximizing your profitability. Happy mining!

EmilySmith

16.06.2024 at 22:49

As a cryptocurrency enthusiast, I believe it’s crucial to stay informed about the most profitable crypto mining options. Keeping up with the latest strategies and tools can help maximise your earnings in this competitive landscape.

EmilyCryptoExpert

30.06.2024 at 15:43

As an experienced miner, I believe that Ethereum offers a more sustainable and profitable mining option compared to Bitcoin. The “proof of stake” algorithm is a game-changer in terms of energy efficiency and accessibility for miners. Monero’s focus on privacy also presents an intriguing opportunity for those looking to diversify their crypto mining portfolio.

EmmaCryptoExpert

04.07.2024 at 01:56

Bitcoin and Ethereum have indeed been leading the way in profitable crypto mining due to their strong networks and popularity. However, Monero’s focus on privacy and ASIC-resistant mining algorithm make it a promising option for individual miners looking to maximize their earnings while ensuring security.

EmilyDavis1987

07.07.2024 at 12:11

As a crypto miner myself, I completely agree with the article’s insights on the most profitable cryptocurrencies. Bitcoin may offer significant rewards, but Ethereum’s efficiency and Monero’s focus on privacy make them attractive options for miners looking to maximize profits in this competitive landscape.

AlexaCrypto12

10.07.2024 at 22:27

What strategies are recommended to optimize mining profitability in the constantly changing crypto landscape?

MaxProfitMiner

17.07.2024 at 18:36

To optimize mining profitability in the ever-changing crypto landscape, it’s essential to regularly research and adapt your mining strategies based on market trends and technological advancements. Additionally, consider diversifying your mining portfolio to spread risks and maximize potential earnings. Stay informed, be flexible, and always be open to exploring new opportunities in the dynamic world of crypto mining.

EmilySmith_1985

14.07.2024 at 08:34

Does the article provide any information on the environmental impact of crypto mining and how it can be mitigated?

DavidJones_1990

21.07.2024 at 04:51

Hey EmilySmith_1985, while the article focuses on the profitability of crypto mining, it does touch on the environmental impact. It mentions that some cryptocurrencies like Ethereum require less energy consumption compared to Bitcoin, which could help in reducing the environmental footprint of mining activities. Implementing renewable energy sources and energy-efficient mining hardware are some strategies to mitigate the environmental impact of crypto mining.

EmilyCryptoExpert

24.07.2024 at 14:58

As a seasoned crypto miner, I believe diversifying your mining portfolio is key to long-term profitability. While Bitcoin may offer significant rewards, the competition and energy consumption can be daunting. Exploring alternative options like Ethereum and Monero could provide a more sustainable mining strategy with lower entry barriers. Stay informed and adapt to the evolving crypto landscape for maximum earnings.

EmmaSmith82

28.07.2024 at 01:17

As a passionate miner, I believe that focusing on the most profitable cryptocurrencies like Bitcoin, Ethereum, and Monero is crucial for maximizing earnings in the competitive crypto mining landscape. Each of these coins has its unique advantages and challenges, requiring miners to stay informed and adapt their strategies accordingly.

AliceSmith123

31.07.2024 at 11:49

Do you have any tips on how to choose the most profitable cryptocurrency to mine based on current market trends?

JohnDoe89

03.08.2024 at 22:06

Sure, Alice! When choosing the most profitable cryptocurrency to mine, it’s important to consider factors such as market demand, mining difficulty, and potential future value. Researching current market trends, staying updated on industry news, and evaluating the technological aspects of different cryptocurrencies can help you make an informed decision. Additionally, joining online mining communities and forums can provide valuable insights and recommendations from experienced miners. Best of luck with your mining endeavours!

EmilySmith

07.08.2024 at 08:18

Can you provide more information on the tools and strategies recommended for optimizing profitability in Ethereum mining?

JackJohnson

10.08.2024 at 18:23

Sure, EmilySmith! When it comes to Ethereum mining profitability, one of the key strategies is to consider joining a mining pool. By pooling resources with other miners, you can increase your chances of earning consistent rewards. Additionally, optimizing your mining rig setup for maximum efficiency can also help boost profitability. Make sure to keep an eye on the latest developments in Ethereum mining software and hardware to stay competitive in the market.

Ella82

14.08.2024 at 04:30

Which cryptocurrencies, besides Bitcoin and Ethereum, are currently considered most profitable for mining?

Charlie88

21.08.2024 at 01:01

Some of the other cryptocurrencies that are currently considered profitable for mining besides Bitcoin and Ethereum are Litecoin, Dogecoin, and Ravencoin. Each of these cryptocurrencies has its own unique features and mining algorithms that can provide opportunities for miners to earn profits. It is important to stay informed about the latest trends and developments in the crypto mining industry to make informed decisions about which cryptocurrencies to mine.

AlexandraSmith

17.08.2024 at 14:30

Could you provide more information on the tools and strategies recommended for optimizing crypto mining profitability?

MaxWilliams

24.08.2024 at 11:06

Sure, AlexandraSmith! When it comes to optimizing your crypto mining profitability, it’s essential to consider factors such as mining pool selection, hardware efficiency, electricity costs, and even proper cooling solutions. Using mining calculators to estimate your potential earnings and staying updated on the latest trends in the mining community can also help maximise your profits. Remember, staying informed and making strategic decisions is key to success in the crypto mining world!

EmilySmith

27.08.2024 at 21:14

What tools and strategies are recommended for optimizing Ethereum mining profitability?

JohnDavis

17.09.2024 at 12:02

Hi EmilySmith, one of the key tools recommended for optimizing Ethereum mining profitability is mining software such as Claymore or PhoenixMiner. Additionally, strategies like pool mining and optimizing your GPU settings can also help increase your earnings. Keep in mind that staying updated with the latest developments in Ethereum mining technology is essential for maximizing profitability. Good luck with your mining endeavors!

EmmaSmith_87

31.08.2024 at 07:22

Is there any information on alternative cryptocurrencies besides Bitcoin, Ethereum, and Monero that are also profitable for mining?

MaxJohnson_92

24.09.2024 at 08:20

Yes, there are several alternative cryptocurrencies besides Bitcoin, Ethereum, and Monero that can also be profitable for mining. Some examples include Litecoin, Dash, and Zcash, each with their own unique features and mining algorithms. It’s always a good idea to research and diversify your mining portfolio to maximize profitability in the ever-changing crypto market.

AmyCryptoExpert

03.09.2024 at 17:38

Are there any other emerging cryptocurrencies besides Bitcoin, Ethereum, and Monero that are worth considering for mining in terms of profitability?

EmmaCryptoExpert

07.09.2024 at 03:52

What are some strategies recommended for optimizing profitability in Ethereum mining given its unique “proof of stake” algorithm compared to traditional mining approaches?

EmilySmith85

10.09.2024 at 14:00

As a cryptocurrency miner, I have found that diversifying my mining portfolio with a mix of profitable cryptocurrencies like Bitcoin, Ethereum, and Monero is key to maximizing earnings. Each coin has its own unique benefits and challenges, but staying informed and adapting to the ever-changing landscape is crucial for long-term success in crypto mining.

Sophia_Green

14.09.2024 at 01:58

Could you provide more information on the tools and strategies recommended for optimizing Ethereum mining profitability?

EmilySmith238

20.09.2024 at 22:09

As a cryptocurrency enthusiast, I believe that staying informed about the most profitable cryptocurrencies to mine is crucial to maximize earnings. Bitcoin, with its significant rewards but fierce competition, requires powerful hardware. Ethereum’s “proof of stake” algorithm is more energy-efficient, while Monero’s focus on privacy makes it an attractive option for individual miners using regular CPUs or GPUs.

EmmaSmith_92

27.09.2024 at 18:26

Do you have any tips on how to choose the best cryptocurrency to mine for maximum profitability?

EmilyCryptoExpert

01.10.2024 at 04:35

As a seasoned miner, I can attest that delving into Bitcoin mining is a challenging yet rewarding venture. The competition is fierce, and the energy consumption is significant, but the potential rewards make it worth the effort. Ethereum presents a more energy-efficient alternative with a strong community backing, while Monero’s focus on privacy makes it an intriguing option for those prioritizing security.

EmilyJones

04.10.2024 at 14:41

Are there any other emerging cryptocurrencies besides Bitcoin, Ethereum, and Monero that are worth mining for profitability?

Alice123

08.10.2024 at 00:56

As a crypto miner myself, I truly believe that staying informed about the most profitable cryptocurrencies for mining is crucial to success in this competitive field. Bitcoin may offer significant rewards, but it also demands powerful hardware and energy consumption. Ethereum, on the other hand, with its “proof of stake” algorithm, presents a more sustainable option for miners with varying resources. Monero, with its focus on privacy and ASIC-resistant mining, is definitely a promising choice for those looking for accessibility and security.

AliceSmith87

11.10.2024 at 10:57

As a cryptocurrency miner, I believe that staying informed about the most profitable options is crucial for maximizing earnings in this competitive industry. Bitcoin may offer significant rewards, but the fierce competition and energy requirements make it challenging. Ethereum’s proof of stake algorithm and community support make it a promising choice for miners with varying hardware capabilities. Monero’s emphasis on privacy and ASIC-resistant mining algorithm make it a viable option for individual miners. It’s essential to adapt to the ever-changing crypto mining landscape to stay ahead.