Is crypto mining still profitable

With the rise of cryptocurrencies like Bitcoin and Ethereum, crypto mining has become a popular way for individuals and companies to earn money. However, as the market has evolved and the difficulty of mining has increased, many are questioning whether crypto mining is still profitable.

One of the main factors that determine the profitability of crypto mining is the cost of electricity. Since mining requires a significant amount of computational power, it also consumes a lot of electricity. As energy costs vary greatly in different regions, some areas may offer more favorable conditions for crypto mining than others.

Another important factor to consider is the price of cryptocurrencies. The value of cryptocurrencies can fluctuate wildly, and mining profitability is directly tied to the value of the coins being mined. If the price of a particular cryptocurrency drops significantly, it can drastically reduce the profitability of mining that coin.

Furthermore, as the mining difficulty increases, more powerful and expensive hardware is required to mine cryptocurrencies effectively. This means that miners need to invest in costly equipment to stay competitive. The cost of purchasing and maintaining mining rigs can eat into potential profits, especially for small-scale miners.

Is Crypto Mining Still Profitable

Mining cryptocurrencies has been a popular way for individuals and businesses to earn profits in the digital world. However, as the landscape of cryptocurrencies continues to evolve, the question of profitability in crypto mining arises.

One of the main factors determining the profitability of crypto mining is the cost of electricity. The energy consumption required for mining can be substantial, and if the cost of electricity is high, it can eat into potential profits. Miners need to carefully consider their electricity expenses and seek out locations with affordable energy rates to maximize profitability.

Another crucial aspect to consider is the value of the cryptocurrency being mined. Market fluctuations can greatly impact profitability. If the price of the cryptocurrency drops significantly, mining operations may become unprofitable. On the other hand, if the value of the cryptocurrency rises, mining can be highly profitable. It is essential for miners to stay updated on market trends and adjust their strategies accordingly.

The hardware used for mining also plays a significant role in profitability. As technology advances, older mining equipment becomes less efficient, resulting in higher electricity costs and lower mining rewards. Miners need to regularly upgrade their hardware to stay competitive and maintain profitability in the ever-changing crypto mining industry.

In addition to these factors, the competition in the mining industry is constantly increasing. More miners entering the market means higher mining difficulty, which in turn reduces individual mining rewards. Individuals and businesses looking to start mining operations need to carefully consider their investment costs and potential returns to determine if mining is still profitable for them.

Despite these challenges, there are still opportunities for profitable crypto mining. Some cryptocurrencies are specifically designed to be more efficient and profitable to mine, offering higher rewards and lower energy consumption. Additionally, mining pools and cloud mining services can help reduce costs and increase the chances of profitability for miners.

In conclusion, while the profitability of crypto mining can vary and be influenced by various factors, there are still opportunities for those willing to adapt and stay informed. By carefully considering electricity costs, staying updated on market trends, upgrading hardware, and exploring efficient mining options, individuals and businesses can continue to profit from crypto mining.

Overview of Crypto Mining

Crypto mining, also known as cryptocurrency mining, is the process of verifying transactions and adding them to a public ledger called the blockchain. This process is performed by miners, who use specialized hardware and software to solve complex mathematical problems. In return for their efforts, miners are rewarded with newly minted coins.

One of the most popular cryptocurrencies for mining is Bitcoin. However, there are also other cryptocurrencies like Ethereum, Litecoin, and Monero that can be mined. The profitability of crypto mining depends on several factors, including the current market price of the cryptocurrency, the cost of electricity, the efficiency of the mining hardware, and the overall network difficulty.

When it comes to mining, there are two main methods: solo mining and pool mining. Solo mining involves a single miner who competes with others to find the solution to a mathematical problem. If successful, the miner receives the full block reward. However, solo mining can be quite challenging and may take a long time to find a block.

On the other hand, pool mining involves multiple miners who combine their computing power to increase the chances of finding a block. The rewards are distributed among the participants based on their contribution. This method is more popular as it allows miners to have a more stable income stream.

While crypto mining can be profitable, it is important to consider the initial investment in mining hardware and the ongoing costs of electricity. Additionally, the mining landscape is constantly changing, with new cryptocurrencies emerging and the difficulty level increasing over time. Therefore, it is crucial to stay informed and adapt to the evolving crypto mining industry.

Understanding Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of central banks. They are decentralized and rely on blockchain technology to store and verify transactions. The most well-known cryptocurrency is Bitcoin, but there are many other cryptocurrencies available.

One of the key features of cryptocurrencies is their ability to provide an alternative to traditional financial systems. They offer lower transaction fees and faster transaction times compared to traditional banking methods. Additionally, cryptocurrencies can be used for peer-to-peer transactions without the need for intermediaries, which can lower costs and increase security.

Another important aspect of cryptocurrencies is their limited supply. Most cryptocurrencies have a fixed maximum supply, which means they cannot be easily manipulated by governments or central banks. This limited supply can make cryptocurrencies an attractive investment option, as their value may increase over time due to scarcity.

However, it’s important to note that cryptocurrencies are also highly volatile and can experience significant price fluctuations. This volatility can make them risky investments, and it’s important to thoroughly research and understand the market before investing in cryptocurrencies.

Cryptocurrencies also rely on mining to secure and verify transactions. Mining involves using powerful computers to solve complex mathematical problems, and miners are rewarded with new cryptocurrency for their efforts. However, as the difficulty of mining increases and the rewards decrease over time, mining cryptocurrencies can become less profitable.

In conclusion, understanding cryptocurrencies is important for anyone interested in the potential benefits and risks they offer. Cryptocurrencies offer alternative financial systems, limited supply, and potential investment opportunities. However, they are also volatile and mining cryptocurrencies may become less profitable over time.

Factors Affecting Mining Profitability

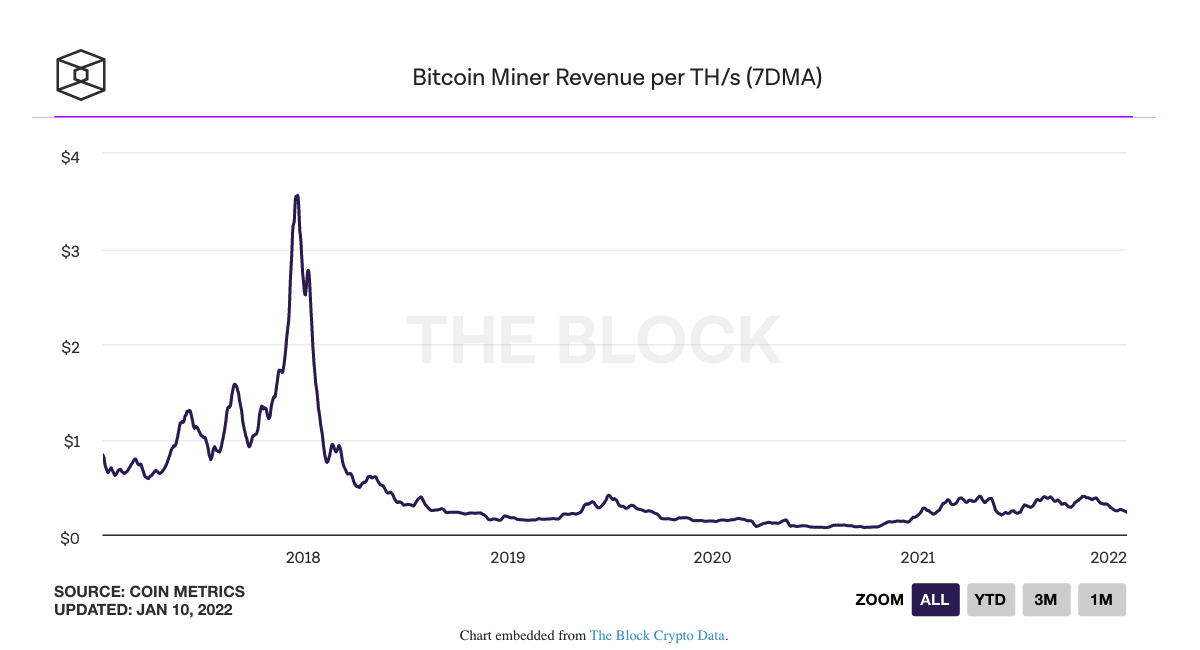

1. Cryptocurrency Market Value: One of the main factors affecting mining profitability is the value of the cryptocurrency being mined. As the market value of a cryptocurrency increases, so does the profitability of mining it. Conversely, if the value of a cryptocurrency decreases, mining it becomes less profitable. Therefore, miners need to closely monitor the market trends and adjust their mining strategies accordingly.

2. Mining Difficulty: Mining difficulty refers to the level of complexity involved in solving the mathematical problems required to validate transactions on the blockchain. As the mining difficulty increases, it becomes harder to mine new coins, resulting in lower profitability. Conversely, if the mining difficulty decreases, mining becomes easier and more profitable. Miners need to take into account the mining difficulty of a cryptocurrency before deciding whether it is worth mining.

3. Energy Costs: Another important factor affecting mining profitability is the cost of energy. Mining cryptocurrencies requires a significant amount of computational power, which in turn requires electricity. If the cost of electricity is high, it can eat into the profits generated from mining. Miners often try to locate their mining farms in regions with cheaper electricity to maximize profitability.

4. Mining Equipment Costs: The cost of mining equipment is also a major factor affecting profitability. High-performance mining rigs can be expensive to purchase and maintain. Additionally, the lifespan of mining equipment is limited, and it needs to be replaced or upgraded regularly to stay competitive. Miners need to carefully consider the upfront and ongoing costs of mining equipment to determine the profitability of their operations.

5. Mining Pool Fees: Most miners join mining pools, which are groups of miners who combine their computational power to increase their chances of mining new coins. In return for using the pool’s resources, miners typically pay a fee. The size of these fees can vary, and they can significantly impact the overall profitability of mining. Miners should compare different mining pools and their fee structures to choose the most cost-effective option.

6. Availability of Cheap Hardware: The availability of cheap mining hardware can greatly affect profitability. As technology advances, new and more efficient mining equipment becomes available. Miners who can access these hardware innovations at a lower cost have a competitive advantage and can achieve higher profitability. It is essential for miners to stay updated with the latest developments in mining hardware and take advantage of cost-effective options.

Cost of Electricity

One of the key factors in determining the profitability of crypto mining is the cost of electricity. Mining cryptocurrencies requires a significant amount of computational power, which in turn consumes a considerable amount of electricity.

The cost of electricity varies greatly depending on geographical location. Some regions have low electricity costs due to government subsidies or abundance of renewable energy sources, while others have high electricity costs due to limited resources or high demand.

Miners need to calculate the cost of electricity per kilowatt-hour (kWh) and consider it in relation to the amount of power their mining equipment consumes. If the electricity costs are too high, it may eat into the profits or even make mining unprofitable.

Another factor to consider is the efficiency of the mining hardware. More efficient hardware can perform the same mining task with lower energy consumption, which can help reduce electricity costs and increase profitability. However, more efficient hardware often comes with a higher price tag.

Miners also need to be aware of any changes in electricity prices or regulations that could affect their mining operation’s profitability. For example, if electricity prices suddenly increase or if there are new regulations that impose additional costs on energy-intensive industries, it could have a significant impact on mining profitability.

Overall, the cost of electricity is a critical factor in determining the profitability of crypto mining. Miners need to carefully consider their electricity costs, choose the most efficient hardware, and stay informed about any changes in regulations or electricity prices to maximize their profits.

Hardware and Maintenance Expenses

When it comes to crypto mining, hardware expenses can be a significant factor in determining profitability. The initial cost of purchasing mining equipment, such as ASIC miners or GPU rigs, can be quite high. These specialized machines are designed to perform complex calculations required for cryptocurrency mining. They are efficient at mining, but they don’t come cheap.

In addition to the cost of the mining equipment, there are also ongoing maintenance expenses to consider. The hardware needs to be regularly updated and repaired to ensure optimal performance. This includes replacing worn-out components, upgrading software, and maintaining cooling systems to prevent overheating. These maintenance costs can quickly add up, especially for larger mining operations.

Furthermore, the energy consumption of crypto mining can also be a significant expense. Mining requires a lot of computational power, which in turn requires a lot of electricity. The cost of electricity varies depending on location, but it can be a substantial portion of the overall expenses. Miners need to take into account the electricity costs and find ways to optimize their energy consumption to maximize profitability.

It is also worth mentioning that the hardware used for crypto mining tends to become outdated relatively quickly. As technology advances and more efficient mining equipment becomes available, older hardware can become obsolete. Upgrading to newer, more efficient hardware can help increase mining profitability but comes with additional costs.

To conclude, hardware and maintenance expenses are crucial aspects to consider when evaluating the profitability of crypto mining. The initial cost of purchasing mining equipment, ongoing maintenance expenses, high energy consumption, and the need to upgrade hardware can all impact the overall profitability of mining operations.

Difficulty Level and Network Hashrate

The difficulty level and network hashrate are crucial factors in determining the profitability of crypto mining. The difficulty level is a measure of how hard it is to find a new block in the blockchain. It is adjusted periodically to maintain a consistent block time.

As more miners join the network, the hashrate increases, leading to a higher difficulty level. Conversely, if miners leave the network, the hashrate decreases, resulting in a lower difficulty level. The difficulty level and network hashrate are directly related: a higher hashrate means a higher difficulty level.

When the difficulty level increases, it becomes more challenging for miners to mine new coins, as they need to solve more complex mathematical problems. This increase in difficulty can have a significant impact on mining profitability, as it requires more computational power and electricity to solve these complex problems.

Miners need to consider the difficulty level and network hashrate when deciding whether mining is still profitable. If the difficulty level increases too quickly or the network hashrate surpasses the mining equipment’s capabilities, the profitability may diminish.

Furthermore, the difficulty level and network hashrate are influenced by various factors, such as the number of miners, mining hardware efficiency, and energy costs. These factors can fluctuate, making it necessary for miners to continuously monitor the difficulty level and network hashrate to make informed decisions about their mining operations.

Overall, the difficulty level and network hashrate play a crucial role in determining the profitability of crypto mining. Miners should carefully analyze these factors and consider their mining equipment capabilities and operational costs to determine whether it is still profitable to mine cryptocurrencies.

Evaluating Profitability in Different Market Conditions

When evaluating the profitability of crypto mining, it is important to take into account the current market conditions. The cryptocurrency market is highly volatile, with prices fluctuating rapidly. Therefore, it is crucial to consider these market conditions to determine whether mining is still profitable.

One key factor to consider is the price of cryptocurrencies. When prices are high, mining can be highly profitable as the value of the mined coins increases. However, during bear markets or periods of low prices, mining may not be as profitable, as the value of the coins being mined decreases.

Another factor to consider is the mining difficulty. As more miners enter the network, the difficulty of mining increases, making it harder to mine new coins. This can impact profitability, as it requires more computational power and energy to mine the same amount of coins. Therefore, it is important to evaluate the mining difficulty in relation to the potential rewards.

The cost of electricity is another crucial factor in determining profitability. Mining requires a significant amount of energy, and the cost of electricity can vary greatly depending on the location. It is important to factor in the electricity costs to accurately assess profitability. Miners in areas with cheap electricity will have a higher chance of being profitable, compared to those in areas with expensive electricity.

Additionally, it is important to consider the mining equipment and its efficiency. More efficient mining equipment can generate higher hash rates and require less energy, leading to greater profitability. However, the initial investment required to purchase high-quality equipment should also be taken into account.

In summary, evaluating profitability in different market conditions requires considering various factors such as cryptocurrency prices, mining difficulty, electricity costs, and the efficiency of mining equipment. By carefully analyzing these factors, miners can make informed decisions and adapt their strategies to maximize profitability in any market condition.

Bull Market vs. Bear Market

Bull Market:

In a bull market, the prices of cryptocurrency are generally rising, and investor optimism is high. This is often accompanied by increased buying activity and high trading volumes. During a bull market, crypto mining can be highly profitable as the price of cryptocurrencies is on the rise. Miners are able to earn more rewards for their computational efforts, making it an attractive time to mine.

Characteristics of a Bull Market:

- Rising cryptocurrency prices

- Increased buying activity

- High trading volumes

- Optimistic investor sentiment

- High mining profitability

Bear Market:

In a bear market, the prices of cryptocurrency are generally falling, and investor confidence is low. This is often accompanied by decreased buying activity and lower trading volumes. During a bear market, crypto mining can be less profitable as the price of cryptocurrencies is declining. Miners may struggle to cover their operational costs, and it may be more challenging to earn rewards for their mining efforts.

Characteristics of a Bear Market:

- Falling cryptocurrency prices

- Decreased buying activity

- Lower trading volumes

- Pessimistic investor sentiment

- Lower mining profitability

It’s worth noting that market conditions can shift between bull and bear markets, and the overall profitability of crypto mining will depend on various factors including the cost of electricity, mining hardware efficiency, and the price of cryptocurrencies. Miners need to carefully evaluate the market conditions and consider these factors before deciding to engage in crypto mining.

Frequent Questions:

Is crypto mining still profitable?

Yes, crypto mining can still be profitable, but it depends on various factors such as the cost of electricity, the price of cryptocurrencies being mined, the efficiency of mining hardware, and the competition in the mining industry.

What determines the profitability of crypto mining?

The profitability of crypto mining is determined by several factors, including the cost of electricity, the mining hardware’s efficiency, the price of cryptocurrencies being mined, the block rewards, and the level of difficulty in mining.

How much can you earn from crypto mining?

The earnings from crypto mining can vary greatly. It depends on factors such as the mining hardware’s efficiency, the cost of electricity, the price of cryptocurrencies, and the mining difficulty. Some miners may earn significant profits, while others may struggle to cover their expenses.

What are the risks of crypto mining?

There are several risks associated with crypto mining. These include the volatility of cryptocurrency prices, the potential for hardware failure, the high energy consumption leading to increased electricity costs, regulatory changes that may affect the profitability of mining, and the competition from other miners.

Is it worth investing in mining equipment?

Investing in mining equipment can be profitable, but it comes with certain risks. The profitability of mining depends on factors such as the cost of equipment, electricity costs, the price of cryptocurrencies, and the mining difficulty. It’s important to carefully consider these factors and do thorough research before making any investment in mining equipment.

How can one increase profitability in crypto mining?

There are several ways to increase profitability in crypto mining. One approach is to use more efficient mining hardware that can mine cryptocurrencies at a higher hash rate while consuming less electricity. Another approach is to lower electricity costs by mining in regions with cheaper electricity rates. Additionally, staying up to date with the latest trends and market conditions can help identify more profitable cryptocurrencies to mine.

Video:

The Downfall of Bitcoin Mining

is a renowned author in the field of cryptocurrency and blockchain. With a deep understanding of the technology and its implications, Dylan has written numerous articles and books on the subject. His expertise lies in explaining complex concepts in a simple and accessible manner, making it easier for readers to grasp the intricacies of cryptocurrency. Dylan’s passion for the industry is evident in his work, and he continues to stay up-to-date with the latest developments in the crypto world.

Grace123

25.10.2023 at 19:39

Is Crypto Mining still profitable? How can miners maximize their profits in the current market?

JohnSmith456

12.11.2023 at 00:17

Hey Grace123, I can definitely understand why you’re wondering if crypto mining is still profitable. The truth is, it’s a bit of a mixed bag right now. While it is still possible to make a profit from mining cryptocurrencies, there are a few things you need to consider.

cryptoqueen

29.10.2023 at 05:44

Is Crypto Mining still worth the effort in making money or is it becoming less profitable?

Crypto Guru

18.11.2023 at 22:19

Hey cryptoqueen, great question! Crypto mining is definitely still worth the effort in making money, but it is becoming less profitable for certain individuals. As mentioned in the article, factors such as electricity costs, cryptocurrency prices, and hardware requirements play a crucial role in determining profitability. However, with the right strategy and access to affordable electricity, there are still opportunities to maximize your mining profits. Stay informed and adaptable, and you can continue to succeed in the crypto mining industry.

LucasBitcoinMiner

01.11.2023 at 15:51

Crypto mining is still profitable if you have access to cheap electricity and can keep up with the latest hardware. It’s all about staying ahead of the game and adapting to the market conditions.

cryptomind22

05.11.2023 at 01:57

Is Crypto Mining still profitable in today’s market? I’m thinking of getting into it, but I’m worried about the costs and risks involved. Can someone enlighten me?

cryptoguru123

29.11.2023 at 07:31

Hey cryptomind22, great question! Crypto mining can still be profitable in today’s market, but it’s important to consider the costs and risks involved. As mentioned in the article, one of the main expenses to consider is the cost of electricity. Depending on your location, the price of electricity can greatly impact your mining profits. It’s also important to keep an eye on the price of cryptocurrencies you’re planning to mine, as their value can fluctuate significantly. Additionally, investing in powerful and efficient hardware can help maximize your mining profits. But make sure to do thorough research and consider the potential risks before diving into crypto mining. Good luck!

Emma88

08.11.2023 at 13:13

Crypto mining used to be a gold mine, but now it’s becoming less and less profitable. With the rising cost of electricity and the volatility of cryptocurrencies, it’s getting harder to make a decent profit. It’s definitely not as easy as it used to be.

JohnCryptoFan

15.11.2023 at 11:18

I think crypto mining is still profitable if you have access to cheap electricity and can afford the necessary hardware. The key is to stay updated with the market trends and adjust your mining strategy accordingly. It’s definitely not as easy as it used to be, but with the right knowledge and resources, there is still money to be made in crypto mining.

JohnSmith007

22.11.2023 at 09:27

I have been mining cryptocurrencies for the past year, and I can say that it is still profitable. Of course, it requires a lot of investment in terms of electricity and hardware, but if you do your research and stay updated with the market trends, you can make a decent profit. Just be prepared for the ups and downs of the cryptocurrency prices.

Emma_Lively

25.11.2023 at 20:31

As someone who has been mining cryptocurrencies for the past few years, I can say that crypto mining is still profitable if you approach it strategically. It’s crucial to consider factors like electricity costs and market conditions to maximize your earnings. Despite the challenges, I believe there are still opportunities to make a decent profit from crypto mining.

DavidCrypto

02.12.2023 at 18:36

Crypto mining is still profitable if you have access to cheap electricity and can optimize your mining operations. However, it’s not as easy as it used to be. The cost of equipment and electricity can eat into your profits, especially during market downturns. It’s important to stay informed and adapt to the changing conditions to maximize your mining profits.

JanetH

06.12.2023 at 05:38

I believe that crypto mining is still profitable, despite the challenges. With the right strategy, low energy costs, and efficient mining equipment, individuals and companies can still make a decent profit. It’s all about staying updated with the latest trends and adapting to the ever-changing market.

Sienna_21

09.12.2023 at 16:42

Is crypto mining still profitable in today’s market?

Aiden_Parker

13.12.2023 at 03:48

Hey Sienna_21, crypto mining can still be profitable in today’s market, but it depends on several factors. As mentioned in the article, one of the key factors is the cost of electricity. If you have access to cheap electricity, it can significantly increase your mining profits. Additionally, it’s important to consider the price of the cryptocurrencies you are mining. If the value of the coins increases, it can greatly enhance your profitability. Lastly, investing in efficient and powerful mining hardware can help you stay competitive and maximize your earnings. So, while it may require some research and investment, crypto mining can still be a lucrative venture if done right. Good luck!

Emily

16.12.2023 at 14:50

Is crypto mining still profitable in today’s volatile market? Are the potential rewards worth the risks involved?

Maxine

27.12.2023 at 00:03

Hi Emily, crypto mining can still be profitable in today’s market, but it requires careful consideration and calculation. The rewards can be significant, especially if you have access to cheap electricity and efficient hardware. However, it’s important to remember that the market for cryptocurrencies is highly volatile, and the risks involved should not be underestimated. It’s essential to stay updated on the latest trends and make informed decisions based on market analysis. Overall, with the right strategy and resources, crypto mining can still be a profitable venture. Good luck!

Anna_D

20.12.2023 at 01:55

Is crypto mining still profitable in today’s market?

James_S

02.01.2024 at 22:17

Hi Anna_D, crypto mining can still be profitable in today’s market, but it’s important to consider several factors. As mentioned in the article, the cost of electricity and the fluctuating price of cryptocurrencies can greatly impact profitability. Additionally, the increasing mining difficulty and the cost of hardware can eat into potential profits. However, with proper planning and understanding of the market, it is still possible to maximize mining profits. Hope this helps!

EmilyCrypto

23.12.2023 at 12:56

As a cryptocurrency enthusiast, I can confidently say that crypto mining is still profitable if approached strategically. It’s crucial to consider factors such as electricity costs and the current value of the coins being mined. With the right setup and careful planning, mining can still be a lucrative venture.

crypto_expert4u

30.12.2023 at 11:14

As an experienced crypto miner, I can confidently say that crypto mining is still profitable if you have the right setup and strategy. It’s important to find a region with low energy costs and invest in efficient hardware. Stay updated on the market trends and adapt accordingly to maximize your profits. Happy mining!

EmmaC94

06.01.2024 at 09:22

I personally believe that crypto mining is still profitable, but it requires careful planning and consideration of various factors. The cost of electricity is a crucial aspect to consider, as well as the current price of cryptocurrencies. As long as you have access to affordable energy and choose the right coins to mine, there is still money to be made in crypto mining. However, it’s important to stay updated on the latest industry trends and adapt to changes in order to maximize your profits.

SarahCryptoAddict

09.01.2024 at 20:28

One thing is for sure, crypto mining is still profitable for those who know how to adapt. With the right hardware and cheap electricity, the potential for high profits is still there. However, it’s important to stay updated on market trends and be prepared for any fluctuations in the value of cryptocurrencies. Mining may not be as easy as it used to be, but with proper research and strategy, it’s definitely still worth it.

JohnSmith2021

13.01.2024 at 07:35

Is Crypto Mining still profitable? I think it depends on a lot of factors like the cost of electricity and the value of cryptocurrencies. It’s definitely not as easy as it used to be, but with the right conditions and equipment, it can still be a profitable venture.

AliceCryptoEnthusiast

16.01.2024 at 18:40

Hi JohnSmith2021! I agree with you that the profitability of crypto mining depends on various factors such as electricity costs and cryptocurrency values. It’s true that it’s not as straightforward as it used to be, but with favorable conditions and the right equipment, it can still yield profit. It’s important for miners to carefully analyze the market and adapt their strategies accordingly. Happy mining!

Adam

20.01.2024 at 05:47

As an avid crypto miner, I can say that it is still profitable if you have access to cheap electricity and the right mining equipment. However, it’s important to constantly monitor the market and adjust your strategies to stay ahead.

crypto_miner44

23.01.2024 at 16:49

Is Crypto mining still profitable? It depends on various factors like the cost of electricity, cryptocurrency prices, and the increasing mining difficulty. But with the right strategy and equipment, it’s still possible to make profits in today’s market.

JaneCryptoExpert

27.01.2024 at 03:54

Yes, I agree with crypto_miner44. Crypto mining can still be profitable if you consider the cost of electricity, the fluctuating prices of cryptocurrencies, and the increasing mining difficulty. With the right strategy and equipment, you can maximize your profits in today’s market.

JohnSmith

30.01.2024 at 15:03

Crypto mining used to be a great way to make some extra money, but with the rising costs of electricity and the volatility of cryptocurrency prices, it’s becoming less and less profitable. Unless you have access to cheap electricity and the latest mining hardware, it’s hard to see how you can still make a decent profit from mining.

Lucas125

03.02.2024 at 02:09

Crypto mining is still profitable if you have access to cheap electricity and can invest in powerful mining rigs. However, it’s not as easy as it used to be and requires a significant upfront investment. Make sure to consider all the costs and risks before getting into crypto mining.

cryptomine1

06.02.2024 at 13:14

Crypto mining is still profitable if you have access to cheap electricity and can afford high-end mining equipment. It may not be as lucrative as before, but with the right conditions, it can still be a decent source of income.

crypto_profits_10

10.02.2024 at 00:15

Personally, I believe that crypto mining is still profitable if you have access to cheap electricity and can keep up with the ever-increasing difficulty. It’s all about finding the right balance between the cost of hardware and the potential profits. Do your research and make informed decisions!

ElliotThinks

13.02.2024 at 11:23

Is Crypto Mining still worth it? I used to be a believer, but with the rise in difficulty and costs, it’s not as profitable as it used to be. You really have to consider the expenses involved before jumping in.

AnnaMines

20.02.2024 at 09:28

Hey ElliotThinks, I totally get your point. Crypto mining profitability has indeed taken a hit with the increasing challenges and expenses involved. It’s crucial to carefully assess the costs and potential returns before venturing into mining. With careful planning and strategic decisions, it’s still possible to make profits, but the landscape has definitely become more challenging. Wishing you the best in your crypto endeavors!

crypto_Enthusiast

16.02.2024 at 22:25

The profitability of crypto mining depends on various factors. As an avid miner, I have found that it is still profitable if you have access to affordable electricity and are willing to invest in high-performance hardware. However, it is important to closely monitor market trends and adjust your mining strategies accordingly.

Alex Turner

23.02.2024 at 20:32

With the rise of cryptocurrencies like Bitcoin and Ethereum, crypto mining has become a popular way for individuals and companies to earn money. However, as the market has evolved and the difficulty of mining has increased, many are questioning whether crypto mining is still profitable.

Emily_84

27.02.2024 at 07:39

Is crypto mining still profitable in today’s market? What are the potential risks and rewards associated with it?

JohnSmith123

05.03.2024 at 05:43

Yes, crypto mining can still be profitable if you carefully manage your costs and stay informed about market trends. The key is to constantly assess your electricity expenses and adapt to changes in cryptocurrency values. While there are risks involved, staying up-to-date with the latest technology can help maximise your profits in the long run.

LilyCryptoEnthusiast

01.03.2024 at 18:39

Is crypto mining still profitable in the current market conditions?

MaxCryptoExpert

08.03.2024 at 16:48

Indeed, crypto mining can still be profitable if approached strategically. It’s crucial to carefully assess factors such as electricity costs, cryptocurrency prices, and hardware investments to maximize profits in today’s market.

Alice Smith

12.03.2024 at 02:49

With the rise of cryptocurrencies like Bitcoin and Ethereum, crypto mining has become a popular way for individuals and companies to earn money. However, as the market has evolved and the difficulty of mining has increased, many are questioning whether crypto mining is still profitable.

EmilySmith_87

15.03.2024 at 12:49

is crypto mining still profitable?

JohnDoe_92

22.03.2024 at 09:01

Yes, crypto mining can still be profitable if you carefully manage your costs and stay updated on market trends. While the initial investment in equipment may seem high, with the right strategy and monitoring, it is possible to generate a steady income from mining cryptocurrencies. Keep an eye on electricity prices and cryptocurrency values to make informed decisions and maximize your profits.

Alexandra89

18.03.2024 at 22:53

In today’s volatile market, crypto mining can still be profitable if approached strategically. It is crucial to factor in the fluctuating electricity costs and keep a close eye on cryptocurrency prices. Investing in efficient hardware is key to staying competitive and maximizing profits in the long run.

CharlotteSmith

25.03.2024 at 19:01

Crypto mining used to be a lucrative business, but with the rising energy costs and the volatility of cryptocurrency prices, it’s becoming less profitable. Miners need to carefully assess their expenses and stay updated on market trends to maximize their earnings.

CryptoEnthusiast69

29.03.2024 at 05:08

As an avid supporter of cryptocurrencies, I still believe that crypto mining can be profitable if approached strategically. It’s essential to carefully calculate the electricity costs and keep a close eye on the market trends. While there are risks involved, with the right resources and knowledge, mining can still yield decent profits in today’s ever-changing landscape.

Sophie_87

01.04.2024 at 15:15

Can someone explain if crypto mining is still a profitable venture considering the rising costs and market fluctuations?

MaxJohnson92

05.04.2024 at 01:26

Yes, crypto mining can still be profitable for those who carefully manage their expenses and stay informed about market trends. While the costs and risks have increased, strategic planning and efficient operations can lead to sustainable profits in the long run.

Emily1989

08.04.2024 at 11:36

Is crypto mining still profitable in today’s market? With the evolving landscape and increasing mining difficulty, I’m curious about the potential risks and rewards. How can one maximize mining profits amidst these challenges?

JohnSmith1985

11.04.2024 at 21:40

Yes, crypto mining can still be profitable if approached strategically. Despite the challenges posed by increasing mining difficulty and fluctuating cryptocurrency prices, there are opportunities to maximise profits. One key aspect is carefully managing electricity costs and exploring regions with favourable rates. Additionally, staying informed about market trends and investing in efficient hardware can help boost profitability. While the landscape may have evolved, there are still ways to succeed in crypto mining.

EmilyCryptoExpert

15.04.2024 at 07:40

As an expert in cryptocurrency mining, I believe that crypto mining can still be profitable if approached strategically. It’s essential to factor in the cost of electricity and the fluctuating prices of cryptocurrencies when evaluating profitability. Additionally, staying updated on mining hardware advancements is crucial to staying competitive in the market and maximizing profits.

JennyCryptoEnthusiast

19.04.2024 at 15:10

As an avid supporter of crypto mining, I believe that despite the challenges, crypto mining can still be profitable if approached strategically. It’s important to carefully assess electricity costs, stay informed about market trends, and consider long-term investment in efficient mining hardware. With dedication and smart decision-making, crypto mining can continue to be a lucrative venture.

AliceB

23.04.2024 at 01:26

As the market has evolved, I believe that crypto mining is becoming less profitable. The rising cost of electricity and the volatility of cryptocurrency prices make it challenging to maximize profits. It’s essential to carefully assess the potential risks and rewards before investing in mining operations.

EmilyCryptoEnthusiast

26.04.2024 at 11:34

As a passionate crypto miner, I believe that despite the challenges, crypto mining can still be profitable for those who approach it strategically. By carefully managing electricity costs and keeping a close eye on market trends, miners can adapt and continue to generate income through mining cryptocurrencies.

EmilySmith_86

29.04.2024 at 22:01

As an experienced crypto miner, I believe that the profitability of mining cryptocurrencies heavily depends on various factors. The fluctuating prices of digital coins and the increasing mining difficulty pose challenges that impact profitability. Before investing in mining equipment, it’s crucial to carefully assess the current market conditions to determine if crypto mining is still a viable option for earning profits.

EmmaCrypto21

03.05.2024 at 08:09

Is crypto mining still profitable in today’s market? With all the factors that affect profitability, such as electricity costs and cryptocurrency value fluctuations, how can miners maximize their profits?

JohnCrypto77

13.05.2024 at 14:45

Yes, crypto mining can still be profitable for those who carefully manage their expenses and stay informed about market trends. Miners should consider factors like electricity costs and hardware requirements to optimise their profits in this evolving market.

EmmaSmith88

06.05.2024 at 18:18

Is crypto mining still a profitable venture in today’s market?

JohnDoe79

17.05.2024 at 00:54

Yes, crypto mining can still be profitable if you carefully manage your expenses and stay informed about market trends. It’s important to keep an eye on electricity costs and adjust your mining operations accordingly. Additionally, diversifying the coins you mine can help mitigate risks associated with price volatility. By staying adaptable and informed, crypto mining can remain a viable source of income in today’s market.

Emma_1987

10.05.2024 at 04:34

Is crypto mining still profitable in the current market conditions? What are the potential risks and rewards associated with it?

Chris89

23.05.2024 at 21:19

Yes, crypto mining can still be profitable if approached strategically. However, it’s essential to carefully analyze electricity costs, cryptocurrency prices, and hardware investments to maximize profits.

EmmaCryptoExpert

20.05.2024 at 10:58

With the current market trends, crypto mining is no longer as profitable as it used to be. The rising electricity costs and the constant need for upgraded hardware make it harder to generate significant profits. Miners should carefully evaluate their expenses and potential returns before diving into the mining business.

Alice Smith

27.05.2024 at 08:01

With the rise of cryptocurrencies like Bitcoin and Ethereum, crypto mining has become a popular way for individuals and companies to earn money. However, as the market has evolved and the difficulty of mining has increased, many are questioning whether crypto mining is still profitable.

Emma92

30.05.2024 at 19:55

Is crypto mining still profitable in the current market conditions? What are the potential risks and rewards involved?

Sam358

03.06.2024 at 06:02

Yes, crypto mining can still be profitable if done strategically. It’s essential to keep an eye on electricity costs and cryptocurrency prices to maximize profits. Investing in efficient hardware is crucial to staying competitive in the market.

JennySmith

06.06.2024 at 16:25

Is Crypto mining still profitable? In my opinion, it really depends on various factors like electricity costs, cryptocurrency prices, and the constantly increasing mining difficulty. It’s crucial to carefully assess the market conditions and costs involved before diving into mining to ensure profitability.

SamRoberts

10.06.2024 at 02:36

Is crypto mining still profitable? Well, considering the fluctuating market conditions and rising mining difficulty, it’s essential to weigh the costs and benefits. Evaluating factors such as electricity expenses and cryptocurrency prices is key to determining the potential profitability of mining. Stay informed and make strategic decisions to maximise your mining profits.

EmilyJones

16.06.2024 at 22:42

As the crypto market continues to evolve and mining difficulty increases, it’s crucial to assess the profitability of mining. Factors like electricity costs and cryptocurrency values play a key role in determining potential profits. Keep track of market trends and make informed decisions to ensure optimal mining returns.

SophiaSmith

13.06.2024 at 12:36

In my opinion, crypto mining can still be profitable if done strategically. It’s crucial to carefully analyze the electricity costs in your region and closely monitor the cryptocurrency market trends. With the right hardware and a good understanding of the market, it’s possible to maximize mining profits. However, it’s important to stay informed and adapt to the changing landscape of crypto mining to remain profitable in the long run.

EmilySmith21

20.06.2024 at 09:04

Is crypto mining still profitable in today’s market? How can individuals maximize their mining profits amidst the evolving market conditions?

DavidJohnson87

23.06.2024 at 19:12

Yes, crypto mining can still be profitable if done strategically. To maximise your mining profits in today’s market, it’s crucial to carefully manage electricity costs, track cryptocurrency price trends, and invest in efficient hardware. Adapting to the evolving market conditions is key to ensuring profitability in crypto mining.

AliceCryptoExpert

27.06.2024 at 05:20

With the volatility in crypto prices and the rising electricity costs, I believe crypto mining is becoming less profitable for individual miners. The barriers to entry are getting higher, and the returns are diminishing. However, larger mining operations may still find a way to make it work by optimizing their processes and lowering their operational costs.

Alexandra1989

30.06.2024 at 15:30

ining still a profitable venture? I believe that considering the rising electricity costs and the fluctuating value of cryptocurrencies, the profitability of mining has become increasingly uncertain. As the mining difficulty rises, the need for more powerful and expensive hardware puts additional financial strain on miners, making it challenging for them to sustain profitable mining operations in the long run.

MarkCryptoEnthusiast

10.07.2024 at 22:22

Yes, crypto mining can still be profitable for those who carefully manage their costs and stay updated on market trends. By monitoring electricity expenses and adapting to changes in cryptocurrency values, miners can position themselves for success in this dynamic industry. While challenges exist, strategic planning and innovation can lead to sustainable profitability in crypto mining.

Susan_1985

04.07.2024 at 01:50

Is crypto mining still profitable in today’s market considering the fluctuations in cryptocurrency value and the increasing mining difficulty?

Mark_Smith

14.07.2024 at 08:27

Yes, crypto mining can still be profitable for those who have access to cheap electricity and can regularly upgrade their mining equipment to keep up with the increasing difficulty levels. It’s important to carefully analyze the costs and potential rewards before diving into mining cryptocurrencies.

EmilyCryptoEnthusiast

07.07.2024 at 12:04

Is crypto mining still profitable in today’s market? How can miners maximize their profits given the evolving conditions?

MaxCryptoGuru

31.07.2024 at 11:34

Indeed, with the dynamic nature of the crypto market, mining profitability is subject to various influencing factors. Miners should carefully monitor electricity costs, adapt to changing cryptocurrency prices, and invest in efficient hardware to stay ahead in the game.

SophieCryptoExpert

17.07.2024 at 18:29

With the current trends in the crypto market, it’s undeniable that crypto mining can still be profitable for those who strategize well. However, potential miners need to carefully consider factors such as electricity costs, cryptocurrency price fluctuations, and the investment required in hardware. It’s crucial to stay informed and adapt to the changing landscape to maximize profits in crypto mining.

CharlieCrypto

21.07.2024 at 04:46

As an avid enthusiast in the crypto mining space, it’s evident that the landscape is shifting. With electricity costs fluctuating and the volatile nature of cryptocurrency prices, profitability is certainly a concern. However, with strategic planning and investment in efficient hardware, there are still opportunities to profit from crypto mining in today’s market.

AlexSmith91

24.07.2024 at 14:53

Is crypto mining still profitable in the current market conditions?

MeganJones84

10.08.2024 at 17:53

Yes, crypto mining can still be profitable if approached strategically. Ensuring you are mining in an area with relatively low electricity costs and closely monitoring cryptocurrency prices can help maximize profitability. Additionally, investing in efficient mining hardware and staying informed about market trends are crucial to staying competitive in the mining industry.

AlexandraSmith22

28.07.2024 at 01:00

With the rapid changes in the market, it’s uncertain whether crypto mining remains lucrative. The rising electricity costs and fluctuating cryptocurrency prices are major obstacles to profitability. Investing in high-performance hardware is becoming increasingly essential, placing a financial strain on miners. It’s crucial to calculate potential risks and rewards meticulously before diving into crypto mining.

Emily_CryptoEnthusiast

03.08.2024 at 21:46

As a long-time crypto miner, I believe that the profitability of crypto mining greatly depends on various factors such as electricity costs, cryptocurrency prices, and required hardware. While it can still be profitable for some, it’s crucial to carefully assess the market conditions and invest wisely to maximise returns.

EmmaCrypto123

07.08.2024 at 07:52

With the volatile nature of cryptocurrency prices and the rising difficulty of mining, it’s becoming increasingly challenging to maintain profitability in crypto mining. Individuals need to carefully assess the cost of electricity, equipment expenses, and market trends to determine if it’s still a viable venture for them.

EmmaSmith101

14.08.2024 at 03:59

With the current trends in the cryptocurrency market, crypto mining seems to be losing its profitability. The increasing complexity of mining operations coupled with fluctuating electricity costs and the volatile crypto prices make it a risky venture. It’s crucial to carefully assess the costs involved and potential returns before deciding to venture into crypto mining.

MarkCrypto87

17.08.2024 at 14:01

With the rapid changes in the market, is crypto mining still a profitable endeavour? The fluctuating prices of cryptocurrencies and the rising costs of energy and equipment make it a challenging venture. Mining may still have potential, but careful calculation and decision-making are crucial in maximizing profits.

SarahCrypto88

03.09.2024 at 17:31

Considering the volatile nature of the market, mining cryptocurrencies can still be a profitable option if approached strategically. Monitoring energy expenses, staying informed about market trends, and making calculated investment decisions are key factors in maximising returns.

EmilyCryptoExpert

21.08.2024 at 00:51

As a seasoned crypto miner, I believe that crypto mining can still be profitable if approached strategically. The key is to carefully assess electricity costs, stay informed about market trends, and continually evaluate equipment efficiency. With the right planning, mining cryptocurrencies can still yield significant returns.

Alexandra88

24.08.2024 at 11:01

Is crypto mining still profitable in today’s market considering the rising costs associated with energy consumption and the volatile nature of cryptocurrency prices?

SamuelCryptoExpert

07.09.2024 at 03:46

Yes, crypto mining can still be profitable for those who strategically manage their operations. While energy costs and price volatility pose challenges, research into efficient mining techniques and staying updated on market trends can help maximize profits. Investing in energy-efficient hardware and balancing risks against potential rewards are key to success in today’s mining landscape.

EmilyCryptoFan

27.08.2024 at 21:08

With the constant evolution of the market, crypto mining seems to be losing its profitability for small-scale miners. The rising energy costs and the volatile cryptocurrency prices are making it harder to maximize profits. Investing in top-notch hardware is becoming a necessity, further squeezing out potential earnings. It’s a tough call whether to continue mining or explore other avenues in the crypto world.

AlexSmith

31.08.2024 at 07:17

ining still a profitable venture in today’s market? It depends on various factors such as electricity costs, cryptocurrency prices, and the evolving mining difficulty. Individuals and companies need to carefully assess these elements to determine if crypto mining remains a lucrative opportunity.

SarahJohnson

10.09.2024 at 13:53

It depends on various factors such as electricity costs, cryptocurrency prices, and the evolving mining difficulty. Individuals and companies need to carefully assess these elements to determine if crypto mining remains a lucrative opportunity.

Emma_Smith

14.09.2024 at 01:51

As the crypto market matures, I believe that crypto mining is no longer as profitable as it used to be. The increasing energy costs and the fluctuating prices of cryptocurrencies make it challenging to maximize profits. Additionally, the constant need for expensive hardware upgrades puts small-scale miners at a significant disadvantage.

AliceCryptoEnthusiast

17.09.2024 at 11:59

Is crypto mining still a profitable venture in today’s market? How can miners adapt to maximize their profits given the changing landscape of cryptocurrencies?

TomCryptoExpert

20.09.2024 at 22:02

Yes, crypto mining can still be profitable if you have the right setup and strategy. Miners can adapt by focusing on energy-efficient mining operations, keeping a close eye on electricity costs, and regularly evaluating the most lucrative cryptocurrencies to mine. Staying informed and flexible is key to maximising mining profits amidst the dynamic crypto market.

EmmaSmith99

24.09.2024 at 08:13

With the growing popularity of cryptocurrencies like Bitcoin and Ethereum, many have embraced crypto mining as a way to make money. However, with the increasing challenges and costs associated with mining, some are starting to doubt the profitability of this venture. The fluctuations in electricity prices and cryptocurrency values play a crucial role in determining whether mining remains a profitable endeavour. As the industry evolves, miners must carefully weigh the risks and rewards to maximize their profits.

EmilySmith2021

27.09.2024 at 18:18

Is crypto mining still a profitable venture given the increasing costs and fluctuations in cryptocurrency values? How can miners maximize their profits in today’s market?

JamesBrown1985

08.10.2024 at 00:50

Hey Emily, crypto mining can still be profitable if done strategically. Miners can consider mining in regions with cheaper electricity to reduce costs and keeping an eye on the cryptocurrency market for profitable opportunities. It’s essential to stay updated with the latest hardware and mining techniques to maximize profits in today’s competitive market.

EmilyCryptoEnthusiast

01.10.2024 at 04:28

With the rapid changes in the crypto market, I believe that crypto mining can still be profitable if approached strategically. However, potential miners should carefully research and consider factors like electricity costs and the volatility of cryptocurrency prices before diving in. The key is to stay informed and adapt to market conditions to maximise mining profits.

EmilyCryptoEnthusiast

04.10.2024 at 14:35

Is crypto mining still a profitable venture considering the fluctuating prices of cryptocurrencies and the increasing mining difficulty?

MarkCryptoExpert

11.10.2024 at 10:51

Indeed, Crypto mining can still be profitable if approached strategically. Understanding the dynamics of energy costs, cryptocurrency prices, and hardware investments is crucial in maximizing profits. With careful planning and adaptation to market changes, mining can remain a viable income source.