Crypto mining taxes

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important.

One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns.

Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances.

Overall, the taxation of crypto mining can be complex and varies from country to country. It is important for individuals and businesses involved in crypto mining to consult with tax professionals or specialists who can provide guidance on the specific tax obligations and reporting requirements in their jurisdiction. Failing to properly report crypto mining income or capital gains from the sale or exchange of mined cryptocurrencies can result in penalties or legal consequences.

Crypto Mining Taxes

Crypto mining has become a popular way to earn money in the digital world, but it’s important to understand the tax implications of this activity. In many countries, including the United States, crypto mining is considered a taxable event. This means that miners are required to report their earnings and pay taxes on any profits they make.

When it comes to taxes on crypto mining, it’s important to keep track of your income and expenses. This includes recording the value of the mined cryptocurrencies at the time they are received, as well as any associated mining costs such as electricity and hardware expenses. These records will be crucial when it’s time to calculate your taxable income.

Depending on your country’s tax laws, the way crypto mining is taxed may vary. In some cases, it may be treated as ordinary income and taxed at your regular income tax rate. In other cases, it may be considered a capital gain or loss, subject to different tax rates. It’s important to consult with a tax professional or accountant to ensure compliance with your local tax laws.

It’s also important to note that crypto mining taxes may not only apply to individuals, but also to businesses or mining pools. If you are running a mining operation as a business, you may be subject to additional tax obligations, such as filing quarterly estimated taxes and keeping detailed records of your mining activities.

In conclusion, crypto mining can be a lucrative venture, but it’s essential to understand and comply with the tax laws in your jurisdiction. Keeping accurate records of your mining activities and consulting with a tax professional can help ensure that you meet your tax obligations and avoid any potential penalties or legal issues.

Understanding Crypto Mining Taxes

As cryptocurrency becomes more popular and widely used, the issue of taxes on crypto mining has gained attention. It is important for miners to understand their tax obligations and how to report their mining income.

When it comes to crypto mining taxes, the most important thing to determine is whether mining activities are classified as a business or a hobby. If mining is considered a business, the income generated from mining must be reported as self-employment income. On the other hand, if mining is considered a hobby, the income is reported as miscellaneous income.

In addition to reporting mining income, miners may also be eligible for certain deductions and credits. For example, miners may be able to deduct expenses related to mining equipment, electricity costs, and other business expenses. It is important to keep detailed records and receipts to support these deductions.

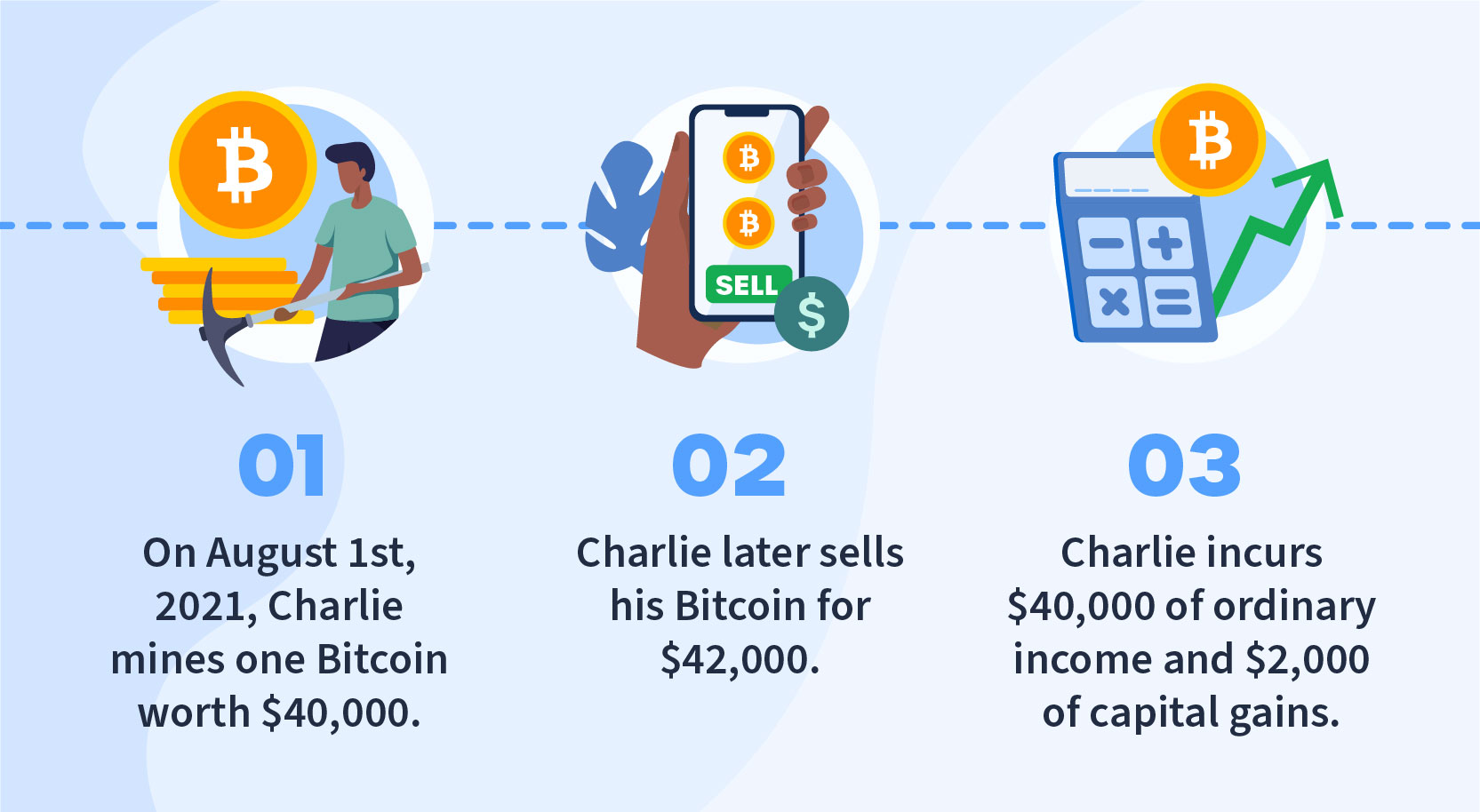

Another important aspect of crypto mining taxes is the treatment of mined coins. In most cases, mined coins are considered taxable income at their fair market value at the time of receipt. However, if the miner holds onto the coins and they appreciate in value, the taxable income may increase when the coins are sold or exchanged.

It is worth noting that tax laws and regulations surrounding cryptocurrency are constantly evolving, so it is crucial for miners to stay informed and seek professional advice if needed. By understanding and complying with crypto mining tax obligations, miners can ensure that they are in compliance with the law and avoid any potential penalties or legal issues.

What is crypto mining?

Crypto mining, also known as cryptocurrency mining, is the process of verifying and adding transactions to a blockchain. It is an essential component of many cryptocurrencies, including Bitcoin and Ethereum. Miners use powerful computers to solve complex mathematical problems, which allows them to validate transactions and secure the network.

When a miner successfully solves a mathematical problem, they earn a reward in the form of newly generated cryptocurrency. This reward serves as an incentive for miners to dedicate their computing power to the network. The mining process requires significant computational resources and consumes a considerable amount of electricity.

Miners utilize specialized hardware, such as ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units), to optimize their mining operations. These devices are designed to perform the calculations necessary for mining more efficiently than regular consumer hardware.

There are different mining algorithms used by different cryptocurrencies, such as Proof-of-Work (PoW) and Proof-of-Stake (PoS). In a PoW system, miners compete to solve mathematical problems, while in a PoS system, miners are chosen to validate transactions based on the number of coins they hold. Each algorithm has its own pros and cons.

Crypto mining has become a lucrative industry, attracting individuals and companies looking to profit from cryptocurrencies. However, it is important to note that mining can be resource-intensive and may not always be profitable, especially as competition and the complexity of mining algorithms increase.

How does crypto mining work?

Crypto mining, also known as cryptocurrency mining, is the process of validating and adding new transactions to a blockchain network. It involves solving complex mathematical problems using high-powered computer hardware.

Miners use their computational power to compete with each other in solving these mathematical problems, which are designed to be difficult to solve but easy to verify. The first miner to solve the problem gets to add a new block of transactions to the blockchain and is rewarded with newly minted tokens.

To participate in crypto mining, miners need specialized hardware, such as graphics processing units (GPUs) or application-specific integrated circuits (ASICs), which are specifically designed for mining cryptocurrencies. These devices are highly efficient at performing the calculations required for mining.

Miners also need to connect to the blockchain network and download the necessary software, which typically includes a mining client and a wallet to store the mined tokens. The mining client communicates with other nodes on the network to verify and add transactions to the blockchain.

As more miners join the network, the difficulty of the mathematical problems increases to maintain a consistent rate of block creation. This ensures that new blocks are added to the blockchain at a predictable pace.

Overall, crypto mining plays a crucial role in maintaining the security and integrity of cryptocurrency networks by decentralizing the process of transaction verification and adding new blocks to the blockchain.

Are crypto mining rewards taxable?

Crypto mining rewards are generally considered taxable income in many countries, including the United States. The taxation of mining rewards depends on the individual’s tax jurisdiction and the specific regulations in place.

When a miner successfully mines a cryptocurrency, they are rewarded with a certain amount of that cryptocurrency. This reward is typically considered as ordinary income and is subject to taxation. The value of the cryptocurrency received as a reward is usually determined by its fair market value at the time it is received.

Miners are required to report their mining rewards as income on their tax returns and pay any applicable taxes. In some cases, miners may also be subject to self-employment taxes if their mining activity is considered a trade or business.

It’s important for miners to keep detailed records of their mining activity, including the date and value of each reward received. These records can help ensure accurate reporting and calculation of taxes owed. It’s also advised to consult with a tax professional or accountant familiar with cryptocurrency taxation to ensure compliance with all tax obligations.

It’s worth noting that tax laws and regulations regarding crypto mining rewards can vary between countries, so miners should always consult their local tax authority or seek professional advice to understand their specific tax obligations.

Reporting Crypto Mining Income

To accurately report your crypto mining income, you need to understand the tax laws and regulations in your country. In many jurisdictions, mining cryptocurrency is considered a taxable activity, and the income generated from mining must be reported on your tax return. Failure to report this income can result in penalties and fines.

When reporting your crypto mining income, it’s important to keep detailed records of your mining activity. This includes documenting the date and time of each mining transaction, the type and amount of cryptocurrency mined, and the fair market value of the mined coins at the time of receipt. These records will help you calculate your taxable income accurately and provide evidence in case of an audit.

It’s also essential to determine whether your crypto mining activity qualifies as a business or a hobby for tax purposes. If you are actively and regularly engaged in mining with the intention of making a profit, it may be considered a business, and you will need to report your income and expenses on Schedule C or the relevant business tax form. If mining is a hobby, you may still need to report the income but with certain limitations.

When reporting your crypto mining income, you should consult with a tax professional or accountant familiar with cryptocurrency taxation. They can provide guidance on specific reporting requirements in your jurisdiction and help you navigate the complex tax laws surrounding crypto mining. Remember, accurately reporting your mining income is crucial to ensure compliance with tax regulations and avoid any potential legal issues.

How to report crypto mining income?

Reporting crypto mining income is essential for fulfilling your tax obligations. When you mine cryptocurrency, you are essentially earning income in the form of newly minted coins or transaction fees. This income needs to be reported on your tax return.

To report your crypto mining income, you’ll need to calculate the fair market value of the cryptocurrency you mine at the time you receive it. This can be done by tracking the value of the mined coins on a reputable cryptocurrency exchange.

Once you have calculated the value of the mined cryptocurrency, you will include it as income on your tax return. In most countries, this income is treated as ordinary income and is subject to tax at your regular tax rate.

It is important to keep accurate records of your crypto mining activities, including details of the coins mined, the date of their acquisition, and the fair market value at the time of receipt. These records will be necessary to support your reported income and can help you in case of a tax audit.

If you are mining cryptocurrency as a business, you may also need to report the income on a separate business tax form. Consult with a tax professional or accountant familiar with cryptocurrency taxation laws to ensure you are reporting your mining income correctly.

Which forms to use for reporting crypto mining income?

When it comes to reporting crypto mining income for tax purposes, it is important to use the appropriate forms to ensure compliance with tax regulations. The specific forms required may vary depending on the country and tax jurisdiction.

In the United States, crypto mining income should generally be reported on Schedule C, which is used for reporting business income and expenses. As a crypto miner, you are considered to be engaged in a trade or business activity, and therefore, you should report your mining income on this form.

Additionally, if you received any payments in cryptocurrency for your mining services, you may need to report these as well. The IRS Form 1099-MISC is typically used to report miscellaneous income, including payments made in virtual currency.

It is important to note that tax regulations surrounding cryptocurrency are constantly evolving, so it is recommended to consult with a tax professional or refer to the guidelines provided by your country’s tax authority to ensure accurate reporting.

What are the tax implications of crypto mining income?

Crypto mining income has tax implications that vary depending on the jurisdiction and regulations of the country in which the miner is operating. In general, crypto mining income is considered taxable and must be disclosed to tax authorities.

1. Classification as a business or hobby: The tax implications of crypto mining income can depend on whether it is classified as a business or a hobby. If mining is considered a business activity, the income generated may be subject to self-employment taxes. However, if it is considered a hobby, the income may be subject to different tax treatment.

2. Reporting income: Miners are typically required to report their crypto mining income on their tax returns. The income can be reported as self-employment income, miscellaneous income, or other applicable income categories, depending on the tax rules of the particular jurisdiction.

3. Deductible expenses: Miners may be able to deduct certain expenses related to their mining activities, such as electricity costs, mining equipment depreciation, and maintenance expenses. These deductions can help offset the taxable income generated from crypto mining.

4. Capital gains and losses: If a miner decides to sell the mined cryptocurrencies, any resulting capital gains or losses may also have tax implications. The tax treatment of these gains or losses can vary depending on factors such as the holding period and the tax rules of the jurisdiction.

5. Compliance and recordkeeping: It is crucial for miners to keep detailed records of their mining activities, including income earned, expenses incurred, and any cryptocurrency transactions. These records will be essential for accurate tax reporting and can help ensure compliance with tax regulations.

It is important for miners to consult with a tax professional or accountant who is knowledgeable about crypto taxation to understand the specific tax implications in their jurisdiction and to ensure compliance with the applicable tax laws.

Frequently asked questions:

Do I have to pay taxes on crypto mining?

Yes, in most countries you are required to pay taxes on the income you earn from crypto mining. The specific tax laws vary by country, so it’s important to research and understand the rules in your jurisdiction. Failure to report and pay taxes on mining income can result in penalties and legal consequences.

How are taxes calculated for crypto mining?

Taxes on crypto mining are typically calculated based on the value of the mined cryptocurrency at the time it is acquired. This value is then reported as income and taxed accordingly. The tax rate may vary depending on your total income and your country’s tax laws. It’s best to consult with a tax professional to ensure you are calculating and reporting your mining income correctly.

What expenses can I deduct as a crypto miner?

As a crypto miner, you may be able to deduct certain expenses related to your mining activities. This can include the cost of mining hardware, electricity costs, internet fees, and any other direct expenses incurred while mining. However, it’s important to note that not all expenses may be deductible, and the specific rules can vary by country. You should consult with a tax professional to determine which expenses you can deduct according to your local tax laws.

What happens if I don’t report my crypto mining income?

If you fail to report your crypto mining income and pay the necessary taxes, you may face penalties and legal consequences. The severity of these consequences can vary depending on the laws of your country and the amount of unreported income. It’s always best to comply with your tax obligations and report your mining income accurately to avoid any issues with the tax authorities.

Videos:

Future of Crypto Mining Taxes in the U.S.

How I Get Ready for Crypto Mining Taxes (USA)

PI NETWORK UPDATE: THIS IS UNBELIEVEABLE , ONLY CHINA CAN NOW MOVE THEIR PI NETWORK TO THE MAINNET

is a renowned author in the field of cryptocurrency and blockchain technology. With over a decade of experience, he has written numerous articles and books that have helped both beginners and experts understand the intricacies of the crypto world. James has a deep understanding of mining hardware and has been instrumental in providing valuable insights to crypto enthusiasts. His passion for technology and commitment to sharing knowledge make him a trusted source in the industry.

crypto_king95

12.08.2023 at 01:05

Is crypto mining income taxable in all countries?

tax_info_junkie99

18.08.2023 at 21:07

Hi crypto_king95, in general, crypto mining income is taxable in most countries. However, the specific tax laws and regulations can vary from country to country. It’s important to consult with a tax professional or your local tax authorities to understand how crypto mining income is treated in your jurisdiction. They can provide guidance on how to correctly report your mining income and ensure compliance with tax obligations. Remember to keep detailed records of your mining activities and any transactions involving mined cryptocurrencies. Hope this helps!

BitcoinMiner87

15.08.2023 at 11:06

Great article. Can you provide more information on how to determine the tax liabilities when selling or exchanging mined cryptocurrencies? Thanks!

CryptoExpert21

29.08.2023 at 03:18

Hi BitcoinMiner87, thank you for your comment. When it comes to determining tax liabilities for selling or exchanging mined cryptocurrencies, it is important to consider the concept of capital gains. Capital gains tax is typically applicable when you sell or exchange an asset, including cryptocurrencies, for a profit. The tax liability is calculated based on the difference between the purchase price and the selling price, also known as the capital gain. The tax rate for capital gains can vary depending on your jurisdiction and the length of time you held the asset. It is advisable to consult with a tax professional or accountant to ensure compliance with your local tax laws. Hope this helps!

JohnSmith01

22.08.2023 at 07:11

What are the specific tax rules for reporting mining income in the UK?

JaneDoe84

15.09.2023 at 05:40

In the UK, the tax rules for reporting mining income are quite straightforward. Any income generated from crypto mining is treated as taxable income and should be reported on your Self Assessment tax return. You will need to keep accurate records of your mining income, including the date and value of each transaction. If you mine as part of a business, you may also need to pay National Insurance contributions. It’s always a good idea to consult with a tax professional or accountant to ensure you are meeting all of your tax obligations.

jackcrypto84

25.08.2023 at 17:13

I’ve been mining cryptocurrencies for a few years now, and let me tell you, the tax implications can be a real headache. It’s important to stay on top of your mining income and report it correctly to avoid any issues with the tax authorities. Plus, don’t forget about the taxes when you sell or exchange your crypto. It’s definitely a complicated topic, but it’s worth taking the time to understand and comply with the regulations. Trust me, it’ll save you a lot of trouble in the long run.

JohnSmith87

01.09.2023 at 13:23

Great article! How will the tax authorities know if I don’t report my mining income?

AlexaBrown82

22.09.2023 at 01:48

Hi JohnSmith87, it’s important to remember that tax authorities have access to various resources and technologies to track financial transactions, including cryptocurrency transactions. While it may be tempting to not report your mining income, it’s crucial to comply with the tax regulations of your local jurisdiction. Not reporting your mining income can result in penalties, fines, or even legal consequences. It’s always best to consult with a tax professional who can guide you through the process and ensure compliance. Hope that helps!

crypto_observer

04.09.2023 at 23:24

Crypto mining is becoming more popular as the value of cryptocurrencies continues to rise. But it’s important to remember the tax implications. Individuals and businesses need to accurately report their mining income to stay compliant with tax authorities. It’s not just about the mining process, but also the selling or exchanging of mined cryptocurrencies that can incur capital gains tax. Stay informed and keep track of your crypto mining activities.

JohnSmith123

08.09.2023 at 09:35

Can you provide more information on the specific tax rules related to crypto mining in the UK?

SarahJones987

28.09.2023 at 22:00

Of course, JohnSmith123! In the UK, the tax implications of crypto mining are governed by HM Revenue and Customs (HMRC). According to HMRC, income from mining activities should be reported as miscellaneous income. This income is subject to income tax, and the specific tax rate depends on your total income for the tax year. It’s important to keep detailed records of your mining income and expenses, as well as any transactions involving the sale or exchange of mined cryptocurrencies. If you have further questions, I recommend consulting with a tax professional who is knowledgeable about cryptocurrency taxation. Hope this helps!

Kate88

11.09.2023 at 19:39

It’s really important to understand the tax implications of crypto mining. Crypto mining income should be reported correctly to comply with local tax authorities. Otherwise, you could face penalties or audits. Stay informed and stay compliant!

MarkCryptoEnthusiast

18.09.2023 at 15:41

I totally agree with the article. As a crypto miner myself, it’s crucial to understand the tax implications and comply with the regulations. Reporting mining income correctly ensures transparency and legitimacy in this growing industry. Let’s not forget about potential tax liabilities when selling or exchanging mined cryptocurrencies. Stay informed and compliant!

JohnSmith101

25.09.2023 at 11:55

Are there any specific guidelines on how to report crypto mining income in the UK?

TaxExpert21

02.10.2023 at 08:05

Hi JohnSmith101, reporting crypto mining income in the UK follows the same guidelines as reporting other taxable income. You would need to keep track of your mining income and report it on your tax returns. It’s important to consult with a qualified tax professional who is familiar with cryptocurrency regulations to ensure compliance with your local tax authorities. If you have any more questions, feel free to ask!

JohnCryptoMiner

05.10.2023 at 18:15

As a crypto miner myself, I’ve had to navigate the complex world of taxes. It’s crucial to accurately report mining income and potential capital gains from selling cryptocurrencies. Don’t overlook your tax obligations – stay compliant with your local tax authorities!

JohnDoe34

09.10.2023 at 04:19

Is it really necessary to report mining income for taxes? How does it work?

JaneSmith89

19.10.2023 at 10:37

Yes, it is necessary to report mining income for taxes. When you engage in crypto mining, the income generated is typically treated as taxable income, similar to income from other sources. This means that you are required to keep track of your mining income and report it on your tax returns. The specific process may vary depending on the jurisdiction you are in, so it’s important to consult with your local tax authorities for guidance on how to correctly report your mining income. Failure to report your mining income can result in penalties and legal consequences.

cryptoenthusiast92

12.10.2023 at 14:26

What are the tax regulations regarding crypto mining in the UK?

taxexpertUK

26.10.2023 at 06:55

In the UK, crypto mining income is subject to taxation. Any income generated from mining activities should be reported as taxable income. Additionally, when selling or exchanging the mined cryptocurrencies, capital gains tax may apply, depending on the specific circumstances. It is important to keep careful track of your mining income and consult with a tax professional to ensure compliance with the tax regulations.

JohnSmith123

16.10.2023 at 00:31

As an avid crypto miner myself, I believe it is crucial to properly report and pay taxes on mining income. It’s important to stay compliant with the tax authorities to avoid any legal issues. I recommend keeping detailed records of mining activities and consulting with a tax professional for guidance.

JohnSmith123

22.10.2023 at 20:39

As someone who has been involved in crypto mining for several years now, I can attest to the importance of understanding the tax implications. It’s crucial to accurately report your mining income to avoid any legal troubles. The regulations surrounding cryptocurrency mining can be complex, but it’s essential to stay compliant with your local tax authorities. Don’t forget to consult with a tax professional to ensure you’re doing everything correctly!

cryptomaster22

29.10.2023 at 16:57

It’s fascinating how crypto mining has become such a lucrative endeavor. However, we shouldn’t forget about the tax obligations that come with it. Reporting our mining income correctly is crucial to ensure compliance with the local tax authorities. Let’s not overlook the potential capital gains tax liabilities when we sell or exchange our mined cryptocurrencies.

JohnCrypto

02.11.2023 at 03:01

I have been mining crypto for a while now and it’s been quite profitable. However, the tax implications can be a bit overwhelming. It’s crucial to accurately report the income from mining activities and ensure compliance with tax regulations. It’s always better to be safe than sorry when it comes to taxes.

Lily123

05.11.2023 at 14:02

Do I need to report my crypto mining income even if I haven’t sold any cryptocurrencies yet?

Richard89

09.11.2023 at 01:07

Yes, Lily123. Even if you haven’t sold any cryptocurrencies yet, you still need to report your crypto mining income. In many jurisdictions, income from mining is treated as taxable income, regardless of whether you have sold your mined cryptocurrencies or not. It’s important to consult with a tax professional or local tax authorities to understand the specific reporting requirements in your jurisdiction. But remember, it’s better to be proactive and compliant from the start than to face potential penalties later on. Happy mining!

crypto_enthusiast_007

12.11.2023 at 12:08

What are the tax rules for mining if I’m located in the UK?

tax_expert_uk

19.11.2023 at 10:15

In the UK, the taxation of crypto mining is treated similar to other income sources. Any income generated from mining activities should be reported on your tax returns. Additionally, if you sell or exchange the mined cryptocurrencies, you may also incur capital gains tax liabilities. It’s important to consult with a tax professional to ensure compliance with the local tax rules and regulations.

CryptoLover23

15.11.2023 at 23:11

I think it’s crucial for crypto miners to understand and comply with tax rules. The income generated from mining should definitely be reported accurately, just like any other source of income. It’s important to be aware of the potential capital gains tax liabilities when selling or exchanging mined cryptocurrencies. Let’s make sure we follow the regulations and avoid any tax problems!

cryptotrader51

22.11.2023 at 23:15

How can I determine the tax implications of crypto mining in my country?

Alexandra

06.12.2023 at 19:45

Hi cryptotrader51! Understanding the tax implications of crypto mining in your country is crucial. To determine the tax rules and regulations surrounding crypto mining, it’s best to consult with a local tax professional or accountant who specializes in cryptocurrency taxation. They will have the knowledge and expertise to guide you through the process and ensure compliance with your local tax authorities. Happy mining!

JohnCrypto123

26.11.2023 at 10:20

As a cryptocurrency miner, I find the tax implications quite daunting. It’s already complicated enough to keep track of the mining income, but now I also have to worry about the potential capital gains tax when selling or exchanging the mined cryptocurrencies. It’s a lot to handle, but I understand the importance of complying with the tax regulations.

Mark73

29.11.2023 at 21:23

It’s getting really complicated to keep track of all the tax implications of crypto mining. I started mining a few years ago and never thought about the tax consequences. Now I’m afraid I’ll get a huge tax bill at the end of the year. I wish there was clearer guidance on how to report mining income and handle the tax liabilities.

crypto_miner123

03.12.2023 at 08:29

I have been involved in crypto mining for a few years now, and I have to say, the tax implications can be quite complex. It’s important to stay up to date with the regulations and report your mining income correctly. Otherwise, you could end up facing penalties from the tax authorities. Stay compliant, folks!

SarahSmith91

10.12.2023 at 06:49

Do I need to report my mining income even if I haven’t sold or exchanged any cryptocurrencies yet?

JohnDoe82

13.12.2023 at 17:58

Yes, SarahSmith91, you should report your mining income even if you haven’t sold or exchanged any cryptocurrencies yet. In many jurisdictions, mining income is considered taxable income regardless of whether or not you sell or exchange the cryptocurrencies. It’s important to keep track of your mining income and report it accurately on your tax returns to ensure compliance with local tax authorities. If you’re unsure about the specific requirements in your jurisdiction, it’s always best to consult with a tax professional.

BitcoinBillionaire

17.12.2023 at 05:01

As a crypto miner myself, I find the tax implications of mining income quite frustrating. It’s important to accurately report our earnings to avoid any trouble with the tax authorities. Keep track of your mining income and report it on your tax returns!

Emily_Ross

20.12.2023 at 16:05

Crypto mining and taxes are such a headache! It’s so hard to keep track of my mining income and report it correctly. Plus, the capital gains tax when I sell or exchange my cryptocurrencies is just another added stress. I wish the tax rules were clearer and more straightforward.

crypto_enthusiast95

24.12.2023 at 03:13

Great article! Can you provide more information on how to calculate the tax liabilities for crypto mining? I want to make sure I’m reporting everything correctly. Thanks!

tax_expert2021

27.12.2023 at 14:23

Hi crypto_enthusiast95, thanks for your comment! Calculating tax liabilities for crypto mining can be a complex process, but I’ll try to provide you with some general guidance. It’s important to note that tax laws can vary between jurisdictions, so consulting with a tax professional is always recommended.

Generally, the first step is to determine the fair market value of the mined cryptocurrencies at the time of receipt. This value will be used as the basis for calculating any potential capital gains when the cryptocurrencies are eventually sold or exchanged.

Next, you’ll need to determine whether you qualify as an individual or a business for tax purposes. This will affect how your mining income is taxed and what deductions or expenses you may be eligible for.

Depending on your jurisdiction, you may be required to report your mining income as self-employment income, business income, or miscellaneous income. Be sure to keep detailed records of your mining activities, including the costs of equipment, electricity, and any other expenses related to mining.

When it comes to calculating the tax liabilities, you’ll need to consider the applicable tax rates and any exemptions or deductions that you may be eligible for. Again, this can vary between jurisdictions, so it’s important to consult with a tax professional to ensure accuracy.

I hope this provides you with some initial guidance. Remember, it’s always best to seek personalized advice based on your specific circumstances. Good luck with your reporting!

cryptomaster99

31.12.2023 at 01:35

Crypto mining is a lucrative business, but it’s important to remember the tax implications. As a miner, you need to accurately report your income and comply with the tax regulations. Stay on the safe side and consult with your local tax authorities to avoid any issues.

JohnCryptoMiner

03.01.2024 at 12:42

How do I determine the value of my mined cryptocurrencies for tax purposes? Is there a specific method to calculate it?

MaryTaxExpert

06.01.2024 at 23:42

Hi JohnCryptoMiner, determining the value of your mined cryptocurrencies for tax purposes can be a bit complex, but there are a few methods you can consider. One common method is to use the fair market value of the cryptocurrency at the time it was mined. This can be determined by looking at reputable cryptocurrency exchanges and using the average trading price for that specific cryptocurrency on the day it was mined. Another method is to use the value of the cryptocurrency when you dispose of it, such as when you sell or exchange it. However, it’s important to consult with a tax professional or accountant to ensure you are accurately calculating and reporting your mining income. Hope this helps!

cryptoMiner2021

10.01.2024 at 10:47

Great article, but I still have some questions. Are there any specific tax rules I should be aware of when it comes to reporting my mining income? How can I ensure compliance with my local tax authorities?

taxExpert27

13.01.2024 at 21:56

Hi cryptoMiner2021, glad you found the article helpful! When it comes to reporting your mining income, it’s important to be aware of the specific tax rules in your jurisdiction. Some countries treat crypto mining income as ordinary income, while others may classify it as self-employment income. Make sure to consult with a tax professional or check your local tax authority’s website to understand the rules that apply to you.

To ensure compliance with your local tax authorities, it’s crucial to keep meticulous records of your mining activities and income. This includes documenting the dates and values of mined cryptocurrencies, as well as any expenses incurred during the mining process. It’s also a good idea to regularly check for updates or guidance from your tax authority, as the regulations surrounding crypto mining can be subject to change.

Remember, accurate and transparent reporting is key to staying on the right side of the law. If you’re unsure about any specific details or have further questions, it’s always best to seek professional advice. Good luck with your mining endeavors!

crypto_miner123

17.01.2024 at 09:01

What are the specific tax rules for reporting mining income in the UK?

Jane_Doe_1985

24.01.2024 at 07:06

Hi crypto_miner123, in the UK, the tax rules for reporting mining income are quite similar to reporting income from other sources. In general, any profits received from mining activities are considered taxable income and should be reported on your tax returns. It’s important to keep accurate records of your mining income and any associated expenses. It’s also recommended to consult with a tax advisor or accountant to ensure compliance with local tax regulations. Hope this helps!

DanielCryptominer

20.01.2024 at 20:06

As a crypto miner, I’ve struggled with the tax implications of my mining income. It’s important to accurately report our earnings to comply with the tax regulations. Keeping detailed records of our mining income is crucial for avoiding any future complications with the local tax authorities.

John_Doe

27.01.2024 at 18:14

I think it’s crucial for individuals and businesses involved in crypto mining to understand and comply with the tax regulations. The income generated from mining activities should be reported accurately to ensure legal compliance and avoid potential penalties. It’s also important to consider the potential tax liabilities when selling or exchanging mined cryptocurrencies. Proper record-keeping and proactive tax planning can go a long way in staying on the right side of the law.

John_Smith

31.01.2024 at 05:19

As someone who has been involved in crypto mining for several years, I can say that the tax implications can be quite complex. It’s important to keep accurate records of mining income and consult with a tax professional to ensure compliance with local regulations. The government wants a piece of the crypto pie!

AlexJohnson24

03.02.2024 at 16:22

It’s really important for crypto miners to understand the tax implications. Failing to report mining income correctly can lead to serious penalties. Make sure to consult with a tax professional to ensure compliance with your local tax authorities.

Oliver_Hunter

07.02.2024 at 03:29

As someone who has been involved in crypto mining for a while, I can say that the tax implications can be quite challenging. It’s crucial to keep accurate records and report your mining income correctly. Otherwise, you may end up with hefty penalties from the tax authorities. Stay informed and compliant!

JohnCrypto

10.02.2024 at 14:43

As a crypto miner myself, I can say that taxes on crypto mining can be quite a headache to deal with. It’s essential to accurately report all mining income to avoid any legal issues. Staying compliant with the tax authorities is crucial in this rapidly evolving industry.

AliceCryptoMiner

14.02.2024 at 01:47

I’ve been involved in crypto mining for a few years now, and I can say that the tax implications can be quite complex. It’s important to accurately report mining income and stay compliant with tax regulations. It’s definitely something to consider before getting into crypto mining.

AndrewJones

17.02.2024 at 13:03

As someone who is actively involved in crypto mining, it’s crucial to be aware of the tax implications. Properly reporting mining income is key to staying compliant with tax regulations and avoiding any potential issues with local tax authorities.

MeganCryptoFan

21.02.2024 at 00:03

As cryptocurrencies gain more traction, it’s crucial to stay informed about the tax implications of crypto mining. Individuals and businesses must accurately report their mining income to ensure compliance with tax regulations. The growing involvement in crypto mining highlights the significance of understanding and fulfilling tax obligations in this evolving landscape.

EmilyCryptoFan92

24.02.2024 at 11:06

Do I need to pay taxes on the cryptocurrencies I mine or only when I sell them? I’m a bit confused about the tax implications of crypto mining. Can someone clarify this for me?

CharlotteCryptoAdvisor

27.02.2024 at 22:11

Hi EmilyCryptoFan92, you’re required to pay taxes on the cryptocurrencies you mine, not just when you sell them. The income generated from mining activities is considered taxable income in many jurisdictions. It’s essential to keep track of your mining income and report it accurately to comply with tax regulations. If you have any more questions about crypto mining taxes, feel free to ask!

Alice Smith

02.03.2024 at 09:16

As someone who is involved in crypto mining, I can attest to the importance of understanding and correctly reporting mining income for tax purposes. It’s crucial to keep track of all mining activities and ensure compliance with tax regulations to avoid any potential issues with the authorities.

EmilySmith87

05.03.2024 at 20:24

As someone who is involved in crypto mining, I find it crucial to stay informed about the tax implications. It’s important to accurately declare and report mining income to comply with tax regulations.

EmilyCrypto

09.03.2024 at 07:25

As someone who has been involved in crypto mining for a while, I can say that navigating the tax implications can be quite complex. It’s crucial to accurately report mining income to avoid any legal issues. Keeping detailed records of all transactions is essential for tax compliance.

EmmaJones89

12.03.2024 at 17:32

How can I ensure that I am correctly reporting my crypto mining income to the tax authorities?

MaxSmith76

16.03.2024 at 03:39

EmmaJones89, to ensure that you are correctly reporting your crypto mining income to the tax authorities, it is crucial to keep detailed records of your mining activities, including the income generated and any associated expenses. Consider consulting with a tax professional who is knowledgeable about cryptocurrency taxation to ensure compliance with the tax rules and regulations specific to your jurisdiction. Additionally, make sure to report your mining income accurately on your tax returns to avoid any potential tax liabilities.

Emma91

19.03.2024 at 13:46

Do you have any tips on how to accurately calculate and report crypto mining income according to tax regulations?

OliverSmith

26.03.2024 at 09:49

Sure, Emma91! When it comes to calculating and reporting crypto mining income for tax purposes, it’s essential to keep detailed records of your mining activities, including the value of the cryptocurrencies mined, the date of acquisition, and the market value at the time. Be diligent in tracking any expenses related to mining, such as electricity costs and hardware purchases, as these can often be deducted from your taxable income. Consulting with a tax professional who is knowledgeable about cryptocurrency taxation can also help ensure accurate reporting and compliance with tax regulations.

EmilySmith91

22.03.2024 at 23:49

As the interest in crypto mining grows, it’s crucial to be aware of the tax implications. Reporting mining income accurately is essential to comply with tax regulations. It’s important for individuals and businesses involved in crypto mining to keep detailed records of their income and report it properly on their tax returns. Additionally, selling or exchanging mined cryptocurrencies may trigger capital gains tax liabilities, so careful consideration of tax rules is necessary.

EmilySmith_89

29.03.2024 at 19:50

As the crypto mining industry expands, it’s crucial for individuals and businesses to stay informed about the tax implications. Reporting mining income accurately is essential to comply with tax regulations and avoid potential liabilities. Proper record-keeping and tax reporting are key in this evolving landscape.

Emily_K

02.04.2024 at 05:52

As the interest in crypto mining continues to rise, it’s crucial to understand and comply with the tax implications. Reporting mining income accurately is essential to avoid any potential issues with the tax authorities. Keep track of your mining activities and income to ensure you meet your tax obligations.

EmmaCrypto

05.04.2024 at 15:55

How can I ensure that I accurately report my crypto mining income to comply with the tax regulations in my country?

JohnCryptoTrader

19.04.2024 at 12:17

To accurately report your crypto mining income and comply with tax regulations in your country, it’s essential to maintain detailed records of your mining activities. Keep track of the value of the cryptocurrencies mined, any expenses incurred during the mining process, and the dates of transactions. Additionally, consider seeking the advice of a tax professional with experience in cryptocurrency taxation to ensure proper compliance. Remember, transparency and accuracy are key when reporting your mining income to local tax authorities.

EmilyCryptoExpert

09.04.2024 at 01:58

As someone who has been involved in crypto mining for years, I can say that navigating the complex tax implications can be quite challenging. It’s crucial to accurately report mining income to ensure compliance with tax regulations. I advise fellow miners to seek professional guidance to avoid any potential issues with the tax authorities.

Emma Smith

12.04.2024 at 12:02

As someone who is involved in crypto mining, I believe it is crucial to stay informed about the tax implications. Reporting mining income accurately and adhering to tax regulations is vital to avoid any issues with local authorities.

EmmaSmith82

22.04.2024 at 22:26

As cryptocurrencies continue to gain popularity, it’s crucial to be aware of the tax implications of crypto mining. Reporting mining income accurately is essential to comply with tax regulations. Individuals and businesses should stay informed about tax rules to ensure proper reporting and avoid potential liabilities.

EmilyCryptoEnthusiast

26.04.2024 at 08:30

As a passionate crypto miner, I believe it’s crucial to stay informed about the tax implications of our mining activities. Properly reporting our mining income is essential to comply with regulations and avoid any issues with tax authorities. It’s important to keep detailed records and understand the tax rules surrounding cryptocurrency mining to ensure smooth operations.

Alexandra_1985

29.04.2024 at 18:41

As someone who has been involved in crypto mining for several years now, I can attest to the importance of understanding and correctly reporting mining income for tax purposes. It’s crucial to stay compliant with local tax regulations to avoid any potential issues with the authorities.

EmmaJohnson

03.05.2024 at 04:47

As cryptocurrencies continue to gain popularity, it’s crucial to understand and correctly comply with the tax implications of crypto mining. Reporting mining income accurately is essential to stay in line with tax regulations and avoid any potential legal issues. Educating oneself on the tax rules surrounding cryptocurrency mining is key to ensuring compliance with local tax authorities.

AlexJohnson

06.05.2024 at 14:49

Do crypto miners have to pay taxes on the value of the cryptocurrencies they mine, or only when they sell or exchange them?

EmmaDavis

23.05.2024 at 17:14

Hi AlexJohnson, in many jurisdictions, crypto miners are required to pay taxes on the value of the cryptocurrencies they mine, not only when they sell or exchange them. It’s important to keep track of mining income and comply with tax regulations to avoid any issues with local tax authorities.

EmilyCryptoEnthusiast

10.05.2024 at 00:54

As someone who is deeply involved in crypto mining, it’s crucial to be aware of the tax implications. Properly reporting mining income is essential to ensure compliance with the law. Remember to keep detailed records of all mining activities and transactions to accurately report income to tax authorities.

LilyCrypto

13.05.2024 at 10:57

Do you have any insights on the tax implications for mining pools or individual miners? How are the tax rules different for each case?

MaxCrypto

30.05.2024 at 16:39

When it comes to tax implications, mining pools and individual miners may face different rules depending on their setup. Mining pools are often treated as business entities, subject to corporate tax rules, while individual miners may be taxed as self-employed individuals. It’s essential to understand the specific regulations in your jurisdiction and consult with a tax professional to ensure compliance.

AmySmith23

16.05.2024 at 20:59

As the tax regulations evolve, it becomes crucial for crypto miners to accurately report their income and comply with the local tax authorities. The growing interest in crypto mining underscores the significance of understanding and adhering to the tax rules concerning cryptocurrency activities.

EmilySmith92

20.05.2024 at 07:12

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important. One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns. Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances. Overall, the taxation of crypto m

EmilyJohnson1985

27.05.2024 at 03:15

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important. One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns. Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances. Overall, the taxation of crypto mining

EmmaCrypto77

03.06.2024 at 02:46

Do individuals need to pay taxes on the cryptocurrencies they mine, even if they don’t sell them?

TomCrypto89

09.06.2024 at 22:50

Yes, individuals typically need to pay taxes on the cryptocurrencies they mine, even if they don’t sell them. In many jurisdictions, the act of mining itself is considered a taxable event, as it generates income in the form of newly minted coins. It’s important to consult with a tax professional to understand the specific tax implications in your jurisdiction.

SarahJohnson87

06.06.2024 at 12:49

Do you have any specific tips on how to accurately report crypto mining income to tax authorities?

MaxTaylor92

13.06.2024 at 08:50

Sure, SarahJohnson87! When reporting your crypto mining income to tax authorities, it’s essential to maintain detailed records of your mining activities, including the value of the mined cryptocurrencies at the time they were acquired. Keep track of any expenses related to mining, such as equipment and electricity costs, as these may be deductible. Consider seeking the advice of a tax professional familiar with cryptocurrency taxation to ensure accurate reporting and compliance with tax regulations.

Alice Smith

16.06.2024 at 18:59

As more individuals and businesses delve into crypto mining, it’s crucial to understand the tax implications. Reporting mining income accurately is key to ensuring compliance with tax regulations. Additionally, the potential tax liabilities from selling or exchanging mined cryptocurrencies must not be overlooked. Stay informed and compliant with local tax authorities!

EmmaMcrypto

20.06.2024 at 05:05

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important. One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns. Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances. Overall, the taxation of crypto m

Alice Smith

23.06.2024 at 15:18

As someone who has been involved in crypto mining, I can attest to the importance of understanding the tax implications. It’s crucial to accurately report mining income to ensure compliance with tax laws. Keeping detailed records of mining activities is essential for a smooth tax filing process.

EmilySmith22

27.06.2024 at 01:22

Could you provide more information on the tax regulations for crypto mining income and how it varies across different jurisdictions?

BenjaminJones89

30.06.2024 at 11:26

Sure, EmilySmith22! The tax regulations for crypto mining income can vary significantly from one jurisdiction to another. In general, most countries treat income from mining as taxable income, similar to other income sources. However, the specific rules and tax rates may differ, so it’s crucial to understand the regulations in your local area and ensure compliance with your tax authorities. If you have any specific questions about tax implications in a particular jurisdiction, feel free to ask!

EmmaCryptoEnthusiast

03.07.2024 at 21:27

As cryptocurrencies gain more traction, it’s imperative to acknowledge the tax implications of crypto mining. Properly declaring mining income is essential to adhere to tax regulations. It’s crucial for miners to stay informed and compliant with tax authorities.

Sarah123

07.07.2024 at 07:44

As someone who is immersed in the world of cryptocurrencies, I can say that crypto mining taxes are definitely a topic that requires attention. It’s crucial to understand the tax implications and ensure compliance with the regulations to avoid any issues with the local tax authorities.

SarahSmith1990

10.07.2024 at 17:53

How can I ensure that I am correctly reporting my crypto mining income for tax purposes? Are there any specific guidelines to follow?

JohnDoe1985

17.07.2024 at 13:55

Hi SarahSmith1990, to ensure that you are correctly reporting your crypto mining income for tax purposes, it’s essential to keep detailed records of your mining activities. This includes documenting the value of the coins mined, the date of mining, and any associated expenses. Additionally, consider seeking guidance from a tax professional who is knowledgeable about cryptocurrency taxation laws in your jurisdiction. Following specific guidelines and accurately reporting your mining income will help you comply with tax regulations and avoid potential penalties.

EmilyCryptoExpert

14.07.2024 at 03:54

As someone well-versed in the crypto world, I believe it’s crucial for miners to stay abreast of tax implications. Reporting mining income accurately and complying with tax rules is paramount. Remember, ignorance of tax laws is not an excuse, so stay informed and play by the rules!

EmmaSmith85

21.07.2024 at 00:00

As someone who’s been involved in crypto mining for a while, I can attest to the importance of understanding and properly reporting mining income for tax purposes. It’s crucial to stay compliant with tax regulations and accurately disclose earnings from mining activities. Additionally, navigating the complexities of capital gains tax implications when selling or exchanging mined cryptocurrencies is a key aspect to consider for anyone in the crypto mining space.

EmilyCrypto

24.07.2024 at 10:00

As a cryptocurrency enthusiast myself, I believe it’s crucial to address the tax implications of crypto mining. Properly reporting mining income is not just a legal requirement but also essential for maintaining a transparent financial record. It’s important for individuals and businesses in the crypto space to stay informed about tax regulations and comply with the authorities to avoid any potential penalties.

EmilyCrypto

27.07.2024 at 20:07

What are the specific tax regulations regarding crypto mining in the UK? Do I need to report my mining income even if I don’t cash out the cryptocurrencies?

JackCrypto

03.08.2024 at 16:32

Hey EmilyCrypto! In the UK, you’re generally required to report your crypto mining income to HMRC even if you don’t cash out the cryptocurrencies. It’s treated as taxable income, so be sure to keep detailed records and consult with a tax professional to ensure compliance!

EmilySmith

31.07.2024 at 06:22

How do I accurately report my crypto mining income for tax purposes?

MaxJohnson

10.08.2024 at 12:47

Hi EmilySmith, accurately reporting your crypto mining income for tax purposes is crucial. You should keep detailed records of your mining activities, including the value of the cryptocurrencies earned and the corresponding exchange rates at the time of receipt. Ensure that you comply with the tax regulations in your jurisdiction and accurately report your mining income on your tax returns. If you have any doubts, consider consulting a tax professional to help you navigate the complexities of crypto mining taxation. Good luck!

Alexandra92

07.08.2024 at 02:37

As the interest in crypto mining continues to rise, it’s vital to be aware of the tax implications. Reporting mining income correctly is crucial to comply with tax regulations. Keeping track of income from mining activities is essential, considering it is taxable in many jurisdictions. Additionally, one must be mindful of potential tax liabilities when selling or exchanging mined cryptocurrencies, as these transactions could lead to capital gains tax obligations.

EmilyCryptoEagle

13.08.2024 at 22:54

As the popularity and value of cryptocurrencies have grown, the taxation of crypto mining is a crucial topic. It’s essential to carefully report the income from mining activities, as it is treated as taxable income in many jurisdictions. Additionally, be aware of potential capital gains tax liabilities when selling or exchanging mined cryptocurrencies. Understanding and complying with tax rules is paramount for all individuals and businesses involved in crypto mining.

Alexandra87

17.08.2024 at 08:55

Could you clarify what specific tax rules apply to cryptocurrency mining income in the UK? I want to ensure I am reporting it correctly to HMRC.

OliverSmith

27.08.2024 at 18:02

Sure, Alexandra87! In the UK, cryptocurrency mining income is typically classified as miscellaneous income for tax purposes. This means that you would need to report your mining earnings on your self-assessment tax return to HMRC. Keep detailed records of your mining activities, including any expenses incurred, as these can potentially be offset against your mining income for tax purposes. It’s always advisable to consult with a tax professional for specific guidance on reporting crypto mining income to ensure compliance with HMRC regulations.

AliceSmith92

20.08.2024 at 21:49

As the interest in crypto mining grows, it’s crucial to stay informed about the tax implications. Reporting mining income accurately is essential to comply with tax regulations. It’s important to keep detailed records to ensure proper reporting and avoid potential tax liabilities related to cryptocurrency transactions.

EmmaSmith2021

24.08.2024 at 07:50

As cryptocurrencies rise in popularity and value, crypto mining has become a significant trend. Properly reporting mining income for tax purposes is crucial. Understanding and complying with the tax rules on cryptocurrency mining are essential to avoid potential penalties from tax authorities.

AlexJohnson

31.08.2024 at 04:06

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important. One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns. Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances. Overall, the taxation of crypto mining

SarahSmith91

03.09.2024 at 14:15

As the interest in crypto mining grows, it’s crucial to understand and properly report mining income for tax purposes. Keeping track of mining activities and potential capital gains tax implications is essential for compliance with tax regulations.

EmmaSmith1990

07.09.2024 at 00:15

Do you have any tips on how to accurately determine the taxable income from crypto mining activities mentioned in the article?

JackDavis1985

13.09.2024 at 20:21

It’s essential to keep detailed records of your mining activities, including the value of the mined cryptocurrencies at the time of receipt. Consider consulting with a tax professional to ensure accurate reporting according to the regulations in your jurisdiction.

MollyCryptoExpert

10.09.2024 at 10:16

As a seasoned expert in crypto affairs, it is crucial for individuals and businesses engaged in crypto mining to fully comprehend the tax implications. The income derived from mining activities should be accurately reported following the local tax regulations. Additionally, careful consideration must be given to potential capital gains tax liabilities when selling or exchanging the mined cryptocurrencies. Staying compliant with tax authorities is paramount in this rapidly evolving landscape.

EmmaCryptoEnthusiast

17.09.2024 at 06:27

Could you provide more information on how capital gains tax liabilities are calculated when selling or exchanging mined cryptocurrencies?

MarkCryptoExpert

20.09.2024 at 16:27

Sure, EmmaCryptoEnthusiast! Capital gains tax liabilities when selling or exchanging mined cryptocurrencies are typically calculated based on the price difference between the acquisition cost of the mined cryptocurrency and the selling/exchange price. This difference is the capital gain, which is then subject to taxation based on the applicable tax rates in your jurisdiction. It’s important to keep detailed records of your transactions to accurately calculate and report your capital gains for tax purposes. Hope this helps!

EmilySmith92

24.09.2024 at 02:34

As the interest in crypto mining grows, it’s essential to understand and comply with the tax implications. Reporting mining income accurately is crucial for individuals and businesses to meet their tax obligations. Considering the potential tax liabilities from selling mined cryptocurrencies is also important to ensure full compliance with tax rules.

EmilySmith92

27.09.2024 at 12:36

As the popularity and value of cryptocurrencies have grown, so too has the interest in crypto mining. Crypto mining is the process of verifying transactions and adding them to the blockchain, typically through the use of powerful computers and specialized hardware. But as more and more individuals and businesses get involved in crypto mining, the question of taxes becomes increasingly important. One of the main issues when it comes to crypto mining and taxes is determining how to report the income generated from mining activities. In many jurisdictions, income from mining is treated as taxable income, similar to income from other sources. This means that individuals or businesses who engage in crypto mining may need to keep careful track of their mining income and report it on their tax returns. Another important consideration when it comes to crypto mining and taxes is the potential tax liabilities associated with selling or exchanging mined cryptocurrencies. When individuals or businesses mine cryptocurrencies, they eventually need to either sell or exchange them for other goods or services. These transactions may trigger capital gains tax liabilities, depending on the jurisdiction and the specific circumstances. Overall, the taxation of crypto m

JennySmith87

30.09.2024 at 22:44

How do I differentiate between taxable and non-taxable income from crypto mining? Is there a specific criteria to follow?

ChrisRoss22

07.10.2024 at 19:38

When it comes to determining taxable income from crypto mining, it’s essential to consider various factors such as the frequency of your mining activities, your intent (casual vs. commercial mining), and whether mining is your primary source of income. Keeping detailed records of your expenses and income from mining can help differentiate between taxable and non-taxable income. Consulting with a tax professional familiar with cryptocurrency regulations can also provide guidance on the specific criteria to follow for accurate reporting.

AuroraJones75

04.10.2024 at 09:16

As the interest in crypto mining has risen, individuals and businesses should be aware of the tax implications. It is crucial to accurately report mining income and comply with local tax regulations to avoid any issues with tax authorities.

EmilyCryptoEnthusiast

11.10.2024 at 05:42

As cryptocurrencies continue to rise in popularity, it’s crucial for miners to grasp the tax implications. Properly reporting mining income is essential for compliance with tax regulations. Moreover, understanding the potential tax liabilities from selling mined cryptocurrencies is vital for responsible tax planning.